By Ewen Stewart – 7 minute read

MAKE NO MISTAKE, we face an economic crisis.

The view that is being curated is that all was relatively fine until those right-wing barbarians, Truss and Kwarteng, ruined the party with their childish economics focusing tax cuts on the rich undermining stable public finances. How dare they! They have wrecked it all! But is it true?

Certainly if you believe Mark Carney, the IMF, Rowntree Foundation, IFS, timid Tories and the mainstream media it was those irresponsible tax cutters. The reality, however, is far more complex.

Over the last fifteen years the UK has seen three major crises: the Global Financial Crisis (GFC); three Covid lockdowns; and now the Ukraine war, bringing its own energy-related inflation crisis. They have all, coupled with the collective response of Governments and central banks, played a large part in this current economic crisis.

But the current crisis is different from the others for during the others sugar was applied, largely in the form of unorthodox monetary policy – this time monetary policy is tightening globally, as in an inflationary environment it must, and the extraordinary era of ‘free money’ is coming to an abrupt end.

The full consequences have not yet been felt.

The story should start well before 2008 but for reasons of brevity let’s begin then with the GFC. Central banks, for honourable reasons, panicked by global financial collapse, adopted highly unorthodox policies.

In the UK case interest rates fell from 5% to 1% and the central bank effectively funded the fiscal deficit through a programme of Quantitative Easing (QE) to buy UK Government Bonds. This policy supressed the yield curve lowering the cost of borrowing to a level well below any credible free market rate. Indeed the rate was the lowest, by a margin in the three hundred year history of the Bank.

The policy was like giving methadone to a Heroin addict, it might save the drug addict’s life but it risks creating a new life-threatening addiction. Prices were reflated, systemic banking system collapse was largely adverted and the economy enjoyed a number of years of suboptimal growth – but at least it was growth. The horror of 1930’s style deflation was averted.

The policy seemed to work but it came with a large price. Asset prices were distorted, arguably leading to lower productivity and weak trend growth. It enabled a large expansion of the State both in absolute and regulatory terms. The crumpled can was kicked down the road.

Perhaps most significantly, however, a major taboo was broken. If you could print money to avoid calamity without apparent pain or an obvious negative side-effect (at least in the short term), might there not be a temptation to use this new found freedom, away from the normal constraints of tax and spend and maintaining an orderly bond market, in the future?

What was unorthodox became the new orthodoxy, at least in central bank circles.

In fairness to Cameron and Osborne they did try and curtail the fiscal deficit and to an extent after 10 long years the country had almost succeeded in a degree of fiscal normalisation. But there had been no attempt at monetary normalisation as interest rates remained – a decade after the crisis – close to zero and £400bn of QE had NOT been unwound. The same was true in the US and even more so in the Eurozone.

Then comes the second great crisis and, in my view, major policy error, enforced lockdown, not just once but three times. The implications of this are numerous and still rupturing across western economies. Perhaps the greatest economic damage for the UK was the £500bn price tag to hibernate the economy was met by more QE and a lowering of rates even further to a tokenistic 0.1%. Money was indeed free.

Here QE was, in my view, far more direct via furlough, bounce-back loans, and the like. Asset prices, notably real estate, fine wine and fast cars went up further in value. It was magic. No need to work anymore, just run the presses, enjoy the summer and when it was all over work from home. Marvellous. Safe it wasn’t.

All along, UK Government debt was racking up. From the inception of the Bank of England in 1694 through to 2005 public debt had grown to £500bn, but became £1,000bn by 2010 and Cameron’s election. Today it is £2,400bn and will soon be £3,000bn. In a short generation public debt has increased six fold. Is there any wonder confidence in fiat currency is low?

By Modern Monetary Theory’s logic it was OK. Print a bit here, withdraw a bit there and the central bankers could run the show abolishing boom and bust with centralised micro management.

But as we came out of lockdown things went a bit wrong. The low inflation environment the West had enjoyed in some things (but by no means all) as a result of low-cost Chinese production, technology and migratory flows undermining local wages, noticeably started to unwind.

The great resignation, supply chain disruption from lockdown, arguably the monetisation of debt through strongly negative real interest rates, all started to stoke inflation. More so, the State had become so big and so inefficient (at a peak of over 50% of the UK economy in 2020) that the drag was real. Britain – and to be fair, much of the West – had transformed from a market-led economy into one where the State was the primary actor led by highly novel monetary policy (to put it politely). All this was before Ukraine.

Then came the third big crisis, war in Ukraine, which has directly led to escalating carbon pricing sending CPI in western economies to the 8-20% range. While carbon prices are volatile it seems to me that inflation will continue to rise, likely peaking around Q2 2023 and even then may well remain stubbornly embedded as the emergence of wage rises, hedging strategies unwinding and margin rebuilding work their way through. This does not seem like a short term phenomena to me.

Suddenly central banks were forced to tighten monetary policy. It was happening before war, but war has certainly greatly added to the pressure. The Fed led but both the Bank of England and ECB followed. But even then, in the light of inflation in high single digits and predicted to accelerate, UK base rates of 2.25% are pretty paltry.

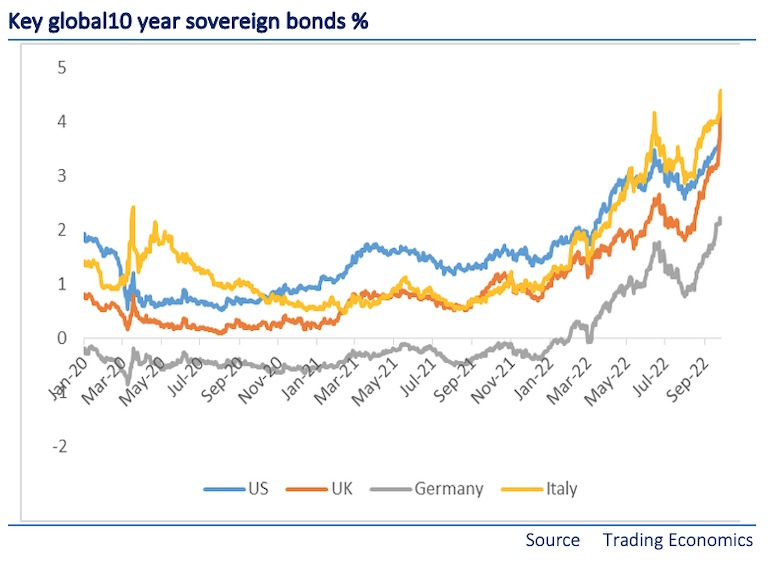

The truth is an unprecedented decade of free money had suddenly came to an abrupt halt. As can be seen by the chart below all countries faced a similar conundrum. The UK is not in splendid isolation here, albeit it you would think it was by the political and media response.

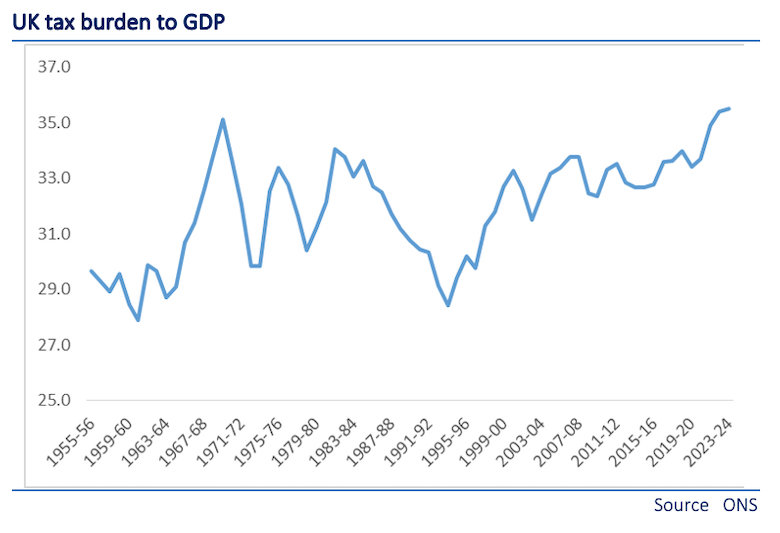

Then steps up Kwasi Kwarteng. He announces a budget which under normal circumstances would make a lot of sense. The UK had moved from a relatively free market, low taxed country to be taxed at its highest rate in 70 years with unheard of regulatory interference.

The scale of the past tax increases are outlined in the chart below and I would challenge readers to highlight exactly what public sector improvements have occurred despite thanks to these tax rises? The truth very clearly is the UK has swapped a successful private sector for an unproductive public one with devastating long-term consequences for the prosperity for all.

Kwarteng’s ideas of reducing the tax burden by around 1.5% GDP was undoubtedly a good start and will simply take aggregate tax back to where it was in 2021 – before Sunak’s tax rises. While I might debate the distribution, that’s hardly radical in an historic context.

This, together with the stated aim of markedly reducing regulation, would in my judgement, in normal circumstances, stimulate growth. But these are not normal circumstances. To announce tax cuts on that scale without explaining how the other side of the equation – spending – would be addressed was, let’s politely say, highly unorthodox, particularly when a week before Truss had announced an energy cap, that depending on assumptions, will likely cost £50-200bn over 2 years. In a nutshell public borrowing would rise from an estimated £55bn next year to around £180bn, only declining slowly thereafter.

While Kwarteng could doubtless point to much higher funding requirements during both the GFC and lockdown, that would miss the point. Then there was QE – now there is none. So who would buy the gilts?

On the eve of Kwarteng’s budget UK 5-year sovereigns, a key benchmark for mortgages, yielded 3.5%. At its worst, before central bank intervention, the yield had moved out to 4.7%. It remains perilously close to that level at the time of writing.

That’s a huge move but as we can see from the 10-year sovereign yield chart above this was a global phenomenon as a result of inflation pressures evident since lockdown and exacerbated by war in Ukraine and the subsequent sanctions policy. Both these decisions were political decisions which made monetary tightening inevitable.

The major error in my view lies with Osborne, Carney, Johnson, Sunak and friends who grew the size of the state so ineffectively (slowly strangling the private sector through tax and regulation) while failing to regularise monetary policy when the sun shone. Instead they preferred to sugar the economy with public spending rather than build sound foundations.

Poor Kwarteng delivered arguably a budget that lacked political nouse for sure and was insensitive in terms of the balance of tax cuts, but it was absolutely required if the UK economy was to have any chance of breaking the death spiral of tax and spend.

To do it, however, without addressing the spending side of the coin, particularly after the energy cap announcements, undoubtedly gave investors an excuse to short gilts and to an extent Sterling (although in truth Sterling’s performance is not that different from the Euro’s which has fallen below USD parity). The idea was great, the timing was not.

To equate, however, Truss and Kwarteng with destroying Sterling is demeaning politics. The truth is sanctions on Russia have undermined both UK and EU competitiveness and both currencies have performed, since the advent of war, pretty well equally poorly. But the problems of this economic crisis are not really about currency but about the cost of borrowing and the impact that will have on the economy. In this context the cost of borrowing is rising everywhere but the reaction to the Budget has been extraordinary in its hostility and coordination with attacks from the IMF, Carney and others from the ‘orthodox school of high tax, regulation and control.’

Recession in my estimation is inevitable throughout the West; in the UK, US and EU. The US will likely fair better than the UK, but I would wager the UK should do better than most of the Eurozone where imbalances remain great and monetary normalisation is very far from complete.

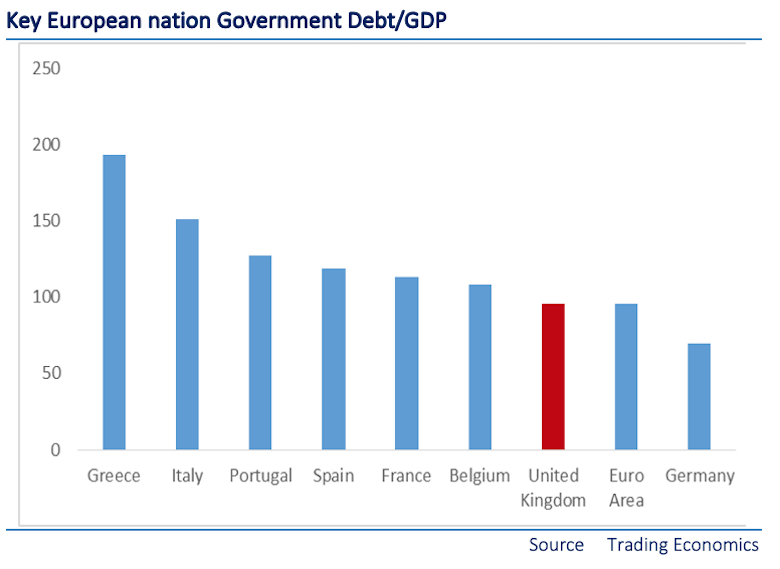

Any inflationary energy and particularly monetary shock of current magnitudes pretty well guarantees problems, but should UK sovereigns really yield more than Italian ones, which they are at the time of writing?

I rather think not for a raft of reasons, not least total public debt to GDP, which is highlighted below. It seems there is rather too much schadenfreude. The chart below shows National debt to GDP where, despite its problems, the UK is somewhat stronger than France and close to the EU average. Yielding more than Italian debt, really?

Don’t get me wrong, I believe the Budget was misjudged. The unfunded tax cuts on that scale were unorthodox. Spending cuts should also have been addressed to normalise the fiscal deficit. The timing was wrong. But the underlying instincts are good and it rather suits the usual suspects to trash the hapless Chancellor forgetting their unorthodox monetary policy, tax, spend and regulatory policies are the real reasons that got us into this mess.

If you If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City Economist whose career has spanned over 30 years. He is Director of Global Britain and his work is widely published in economics and political journals.