by Ewen Stewart – 4 minute read

THE Tax Payers Alliance (TPA) has published a timely and rigorous report under the somewhat arid title of Coronavirus fiscal measures in the OECD. Do not let this dry description put you off. It is an excellent report and required reading giving hard data to support many of the articles that have occurred on these pages over the last few years.

The report contrasts the UK’s approach to lockdown with key OECD comparators; France, Germany, Japan, Norway, Sweden and the US – and in almost every respect the UK’s performance is far worse than those other countries.

If anything, the TPA analysis is generous to the UK Government as it takes a narrow definition of spending and also looks at the impact to the end of 2022, thus it is beyond the paper’s scope to look at the continuing subsequent aftershocks which have been almost universally negative.

Taking the National Audit Office definition of coronavirus excess spending of £376bn (which in my view is a highly conservative estimate, because it only includes identifiable spending from February 2020 to March 2022 and excludes longer term societal impacts like permanently increased public spending in general and NHS spending in particular) to vainly attempt to reduce the impact of lockdown-induced service disruption, wider societal change and lost productivity, the TPA analysis shows the UK’s lockdown ‘above the line’ spending as a proportion of GDP was second only to the US and 4x that of Sweden, 3x Norway and almost twice the level of French spending.

The result of this largesse was almost entirely negative in the medium and longer term.

The TPA analysis again confirms the UK performed poorly with relatively high ‘excess deaths’ despite increasing health spending proportionately more than any of the other major countries the TPA examined (and twice as poorly as lockdown-lite Sweden who barely increased health spending at all).

If anything there appears some statistical inverse correlation between excess coronavirus related health expenditure, as a proportion of GDP, and excess mortality. Whichever way one examines it, the UK’s bang for health spending buck was and remains appalling.

If the UK’s health outcomes were poor, the economic ones were even worse. While the UK spent similar proportions to Germany and Japan although far more than France, Sweden and Norway on non-health measures the UK approach was almost entirely counter-productive, focused on an absurdly generous furlough scheme, bounce back loans and the like.

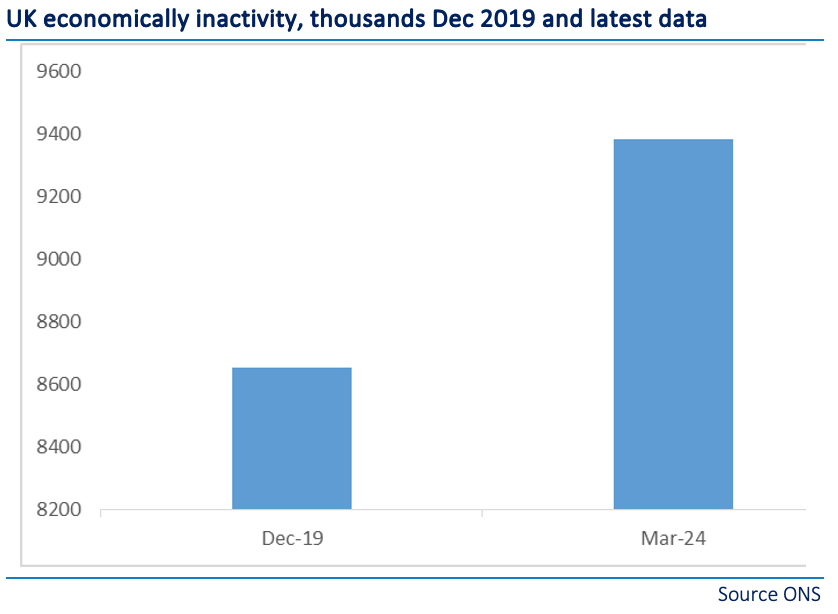

The long term impacts of this are still being felt and it has arguably been a major contributor to the increase in worklessness which now stands at almost 9.4 million individuals, a material increase on the eve of lockdown and a very substantial cost in terms of transfer payments, lost productivity and personal opportunity.

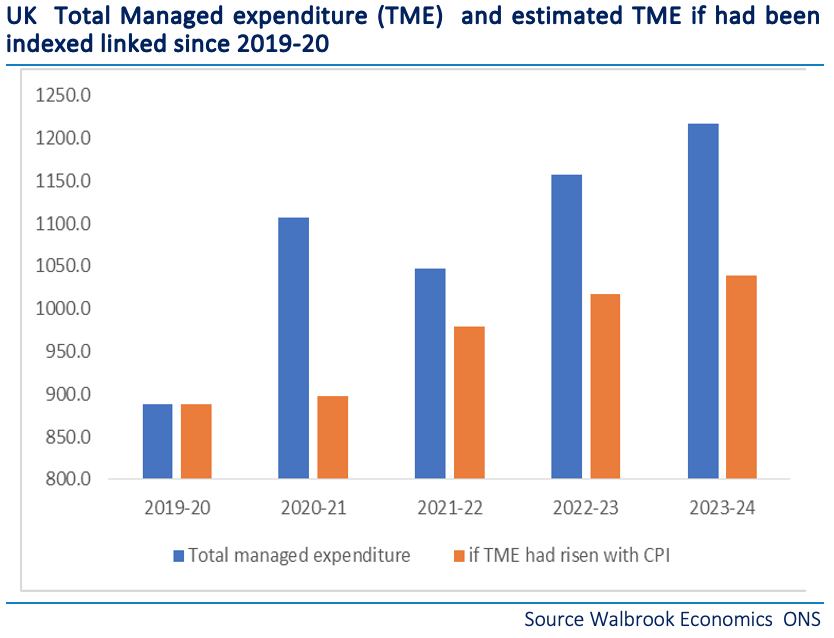

What the impact of UK coronavirus policy also has done is to permanently embed higher degrees of public spending even after the restrictions were lifted. If we examine public spending (as defined as total managed expenditure) according to the Office of Budgetary Responsibility (OBR) it stood at £888.4bn in 2019-20. This rose by 24% the subsequent year before some of the excess lockdown spending rolled off.

However over the last two years public spending has accelerated again rising to £1216bn in the last financial year. This is some £177bn, or £6300 a household, more than it would have been if spending had increased in line with CPI.

These sums are unprecedented in peace time.

Where has the money gone? Largely on a substantial increase in the public sector workforce despite deteriorating service, higher social protection payments particularly in areas like mental health and long term sickness, and higher public sector salaries which generally have outpaced private sector averages despite clearly substandard productivity performance.

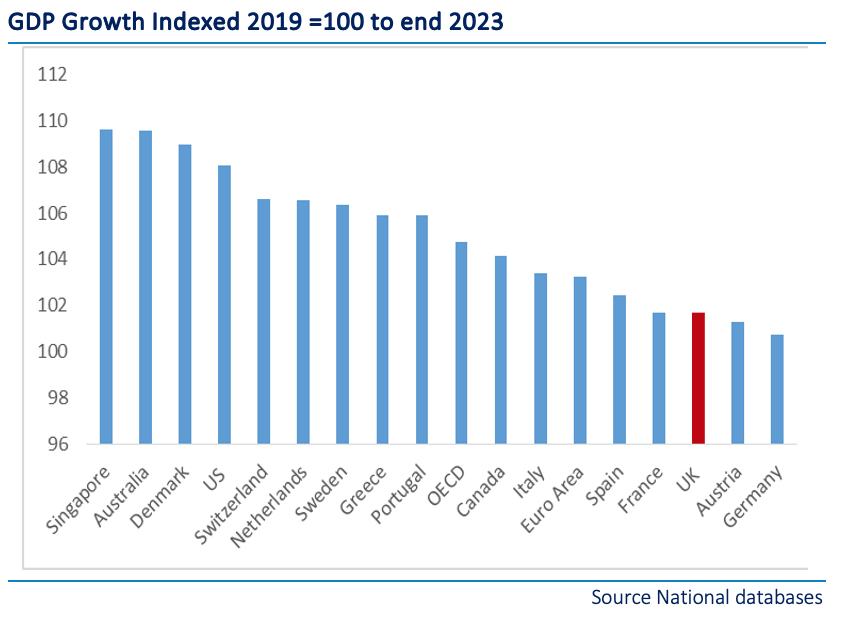

While not explicitly discussed in the report, if we index GDP growth from just prior to lockdown to end 2023, we can see just how poorly the UK has rebounded. Excluding Austria and Germany, the UK economy’s compound GDP growth since 2019 is the weakest of key nations with Singapore, Australia, Denmark and the US in particular outperforming the UK very materially. Even Italy has done rather better!

While of course there are a range of factors behind this and isolating the lockdown impact is to an extent subjective,what can be concluded is the UK’s highly generous approach has yield very poor results. This is hardly surprising as the UK has increasingly swapped a productive private sector for a relatively unproductive public one. UK coronavirus policy turbocharged that process.

The TPA paper also does a great service in reminding readers that inflation was rising well before the invasion of Ukraine. It is often rather conveniently argued that the inflationary ‘spike’ was solely a result of the war and subsequent impact on oil and other commodity markets. Clearly the latter events were unhelpful and a factor but let’s not forget that CPI was accelerating due to lockdown impacts as well as through the direct results of supply chain disruption, dislocated capital flows, employment disruption and the like.

The TPA has produced an excellent report. It clearly shows the UK’s performance on almost all measures is dreadful. The UK spent more, less effectively with very poor outcomes. Increased health expenditure has had no positive impact at all while the so called ‘kindness’ of furlough has had predictably the opposite impact of what was intended.

The UK is now a serious underperformer but with a new Government likely to double down on the failures of the previous one. The tragic lesson of the UK policy response has not been learned – or worse, has been used as an excuse to turn the spending taps on to a seriously failing structure.

If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City economist whose career has spanned over 30 years. He is director of Global Britain and a co-founder of Brexit-Watch.org.