By Catherine McBride

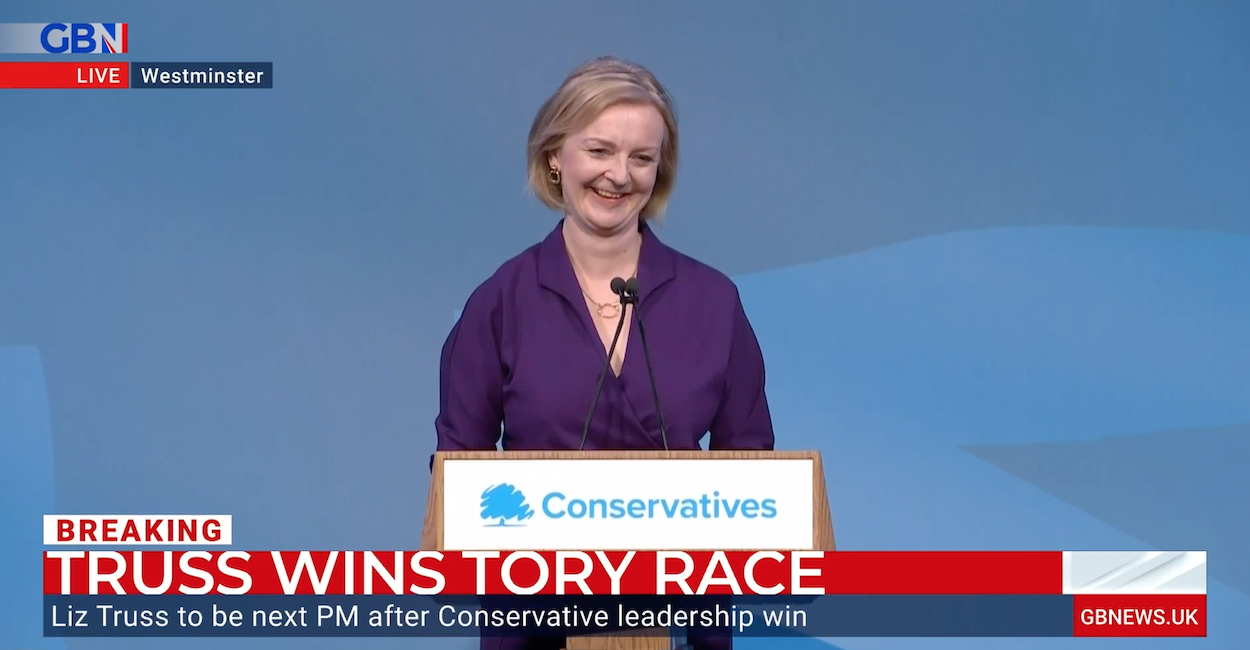

LIZ TRUSS has been elected leader of the Conservative & Unionist Party and will now go on to be invited to form a Government by HM the Queen. Here are eight points she should consider to tackle the energy crisis.

1. Cut VAT and CCL on energy bills for Domestic and Business use

VAT on energy bills, electricity, gas, heating oil and solid fuel: all are presently rated at 5% for residential use and 20% for businesses. This is madness. Energy is existential for businesses. Whether they are making cement or running a dealing room, without power – they’re closed.

Businesses, like governments, don’t have any money of their own. Their money comes from their customers, so the VAT and Climate Change Levy (CCL) added to their energy bill will be added to their cost of production, which will be recouped in the price of their products, that may also have VAT added to their sale price. The Government can hardly claim to be worried about inflation if they are happy to increase the cost of production of most goods and services with VAT as well as the final sales price of the same goods and services.

As for domestic energy, this is just as essential to life in the UK as food and children’s clothes. Water supplies and sewage services are rightly zero rated, so the new PM should also zero rate other utilities such as gas and electricity.

2. Take emergency powers to open new drilling, especially fracking

Gas prices are high because the continent of Europe has chosen not to develop their gas reserves. Without Russian gas, Europe is short by about 40% of their annal gas usage.

Fracking is the quickest way to increase our gas supply, however the Government should also grant permission for more North Sea oil and gas although these will take longer to be productive.

We already know the exact location of the UK’s gas reserves – both under the North Sea and on land but these fields haven’t been started because they are being held up in court by a handful of very well financed green activists, or they lack investment funds due to fears of stranded assets or low ESG scores.

The new Prime Minister has to override petty objections and long lead times on planning decisions if the UK is to avoid being spun like a top by Putin in his economic war with the West.

3. Ensure a proportion of new gas licences must be sold in the UK

The New Prime Minister should follow the Western Australians and add a clause in any drilling license that requires a percentage of the gas retrieved from sovereign waters is sold domestically. Western Australia chose 15%, but their population and gas requirement is small compared to the UK. This may be unnecessary as the UK is likely to be the largest buyer and highest bidder for new sovereign gas for some time to come. But if it makes the population feel comfortable – and it will – the Government should add a domestic use clause to any granted gas permissions.

4. Repeal Sunak’s Windfall Tax – instead give firms a tax break on increased production

It is madness to discourage increased supply by charging a windfall tax on oil and gas producers when there is a shortage of oil and gas. It is not their fault that they are in the right place at the right time. And we should be very glad that they are. Prices are set by demand, and we set our own anti-hydrocarbon agenda that has allowed Putin to lower supply and set our gas prices for us.

As for the idea we should put windfall taxes on the North Sea output of large multinational oil and gas companies: Well, the clue is in the word multinational. At best this encourages them to pump more gas from their fields in Mauritania, Algeria, Senegal, Angola, Libya, Azerbaijan, Turkey et al and ship it to the UK to benefit from UK prices.

5. Repeal the May and Johnson acts on emission reductions

Higher prices should increase supply, but government regulations, lack of investment funds due to fears of having Stranded assets after 2035 and activist legal challenges have made it impossible for supply to increase in the UK and return prices to equilibrium levels.

The easiest way for the government to get around the activists’ legal roadblocks is to repeal Theresa May’s Statutory Instrument rushed through parliament in June 2019. The UK became the first major economy to set net zero emissions targets into law requiring it to eradicate its net contributions to climate change by 2050. Boris Johnson’s Government made this worse by adding a legal target of a 78% reduction in emissions by 2035. This gives activist groups the ability to take the Government to court for approving North Sea oil and gas fields by claiming that allowing the field to operate would contravene our emission reduction laws. Even though Greenpeace has lost its legal cases, it is well financed enough to appeal to a higher court. Repealing these emission regulations should make such court cases more difficult and should be on the new Prime Minister’s to-do list. Preferably rushed through in another Statutory Instrument.

6. Review wind turbine operators’ contracts to ensure they sell power to the grid at the contract strike price.

Wind turbine operators with contracts that allow them to sell their ‘free’ energy either at the strike price in their contracts or at the market price, (which is based on the gas price of electricity), are keeping UK electricity prices high even during the winter when a third or more of our energy is coming from wind power. Wind turbines and solar farms are marketed to the population as being ‘free’ but the energy they produce is not free to the population and never will be, even if we change the contracts. The strike prices are more than adequate compensation for turbine operators – if they weren’t they wouldn’t have built the turbines.

7. Don’t subsidise energy bills

The Government should not subsidise domestic energy use. High prices incentivise consumers to lower their energy use which is important when we do not have enough electricity to go around. Subsidies would allow consumers to avoid changing their behaviour.

It is also worth reiterating that the price cap is on the price per kilowatt hour, the total bill is not capped. If you use less, you pay less. High prices incentivise lower use.

Until we have unlimited domestic gas or unlimited nuclear power at our disposal, we need to be conscious of how much energy we use.

No one wants to see black-outs, brown-outs, or energy rationing – especially as energy is existential for most businesses. Whether you are making cement or running a dealing room – without power your business is closed. Luckily most businesses in the UK have annual or multi annual energy contracts, so many will avoid the present price spike. But for businesses whose contracts are expiring this autumn – their new contract will be considerably more expensive.

Many of the UK’s businesses moved their manufacturing to countries with lower costs some years ago. According to the ONS, energy use by industry, source and fuel, 1990 to 2020, 60% of UK natural gas use in 2020 was for domestic heating and electricity production. Other industries are very low users of natural gas with the exception of the oil and gas industry itself. Although the natural gas used in the production of cement, fertiliser, lime and methanol are not given individually by the ONS, they are included along with other confidential users in the total for all energy use. Combined, at most, they could have used 8% of natural gas consumption in 2020. But these industries, as large continuous gas users are most likely to have long term contracts.

Interestingly, total natural gas consumption for domestic heating has dropped by about 20% since the early 2000s. Considering the population increase over the same period – we are using much less gas in our homes.

8. Don’t nationalise energy companies.

Gas prices are high because Europe does not have enough gas. The continent of Europe does have enough gas reserves but has chosen not to develop them. Without Russian gas, Europe is short by about 40% of its annual gas usage. When Russia turned off their gas pipelines, prices increased internationally but especially in Europe – the main market for piped Russian gas.

Nationalisation will not change this supply constraint. Putting a government bureaucrat in charge of UK oil and gas companies will not enable them to magic up 40% of Europe’s gas if the present astronomical prices aren’t a sufficient enticement.

Nationalising the oil and gas companies would just cost taxpayers a fortune, and nothing would have changed regarding the supply. Worse still, unless the government changes its net zero targets – the companies would be worthless by 2035.

More details of all of the above will be published shortly.

Catherine McBride is an economist who writes about Trade and agriculture. She is on the Government’s Trade and Agriculture Commission and is a fellow of the Centre for Brexit Policy.

Catherine McBride

5 September 2022