By Ewen Stewart – 5 minute read

OH DEAR, I’ve just spent the last two minutes watching this video where Chancellor of the Exchequer Jeremy Hunt cheerfully explains what he thinks has caused inflation and what he’s doing about it.

Don’t waste two minutes of your precious time on it. He blames everyone but himself for this crisis. It’s Covid, Putin and likely continuing high energy prices for this mess. That’s all he says on the why.

Even more laughable he then goes on to explain his plan to half inflation – which is built on ‘investing money in renewables, encouraging energy efficiency and taking the difficult decision to balance the nation’s books.’

His analysis of why UK inflation is the worst of any developed nation in the world is selective in extremis while his plan to control it is just plain wrong and is a complete misunderstanding of the largely self-inflicted problem.

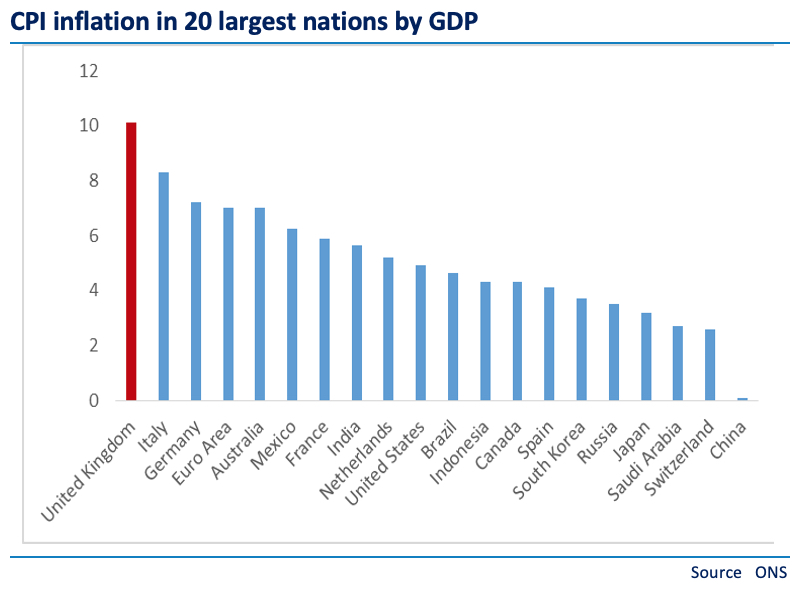

Firstly, a bit of context. As outlined by the chart below it is a matter of record that the UK currently has the worst inflation of any major economy on earth, Russia included.

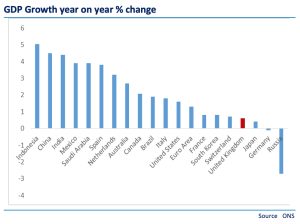

Moreover, it is not that the UK economy is actually performing well. It’s not. Again GDP growth is one of the lowest of any major nation.

So why are we in this mess?

There are numerous reasons why inflation in the UK is so bad. Here’s the main ones none of which Hunt seems to think are worth mentioning:

- The Bank of England, in common with other major central banks, adopted a highly unusual monetary policy for well over a decade with aggressive Quantitative Easing designed to suppress the cost of debt. The initial scale, £479bn or around 25% of GDP between 2009-14 was unprecedented. Coupled with adopting an interest rate policy of near zero this distorted asset prices, and broke the age-old check and balance on Governments where their spending had to be broadly related to tax raised.

- This policy, while arguably justified as an emergency measure, remained for over a decade. QE was not unwound and the Bank of England kept rates at an ultra-low level maintaining the unproductive sugar rush. This was a major policy error as it had a decade to normalise policy but took the easy delusional option.

- The Government and central bank thought this was clever micro-management of the economy running it on hot as it thought there was no inflation. It was sort-of right on its narrow definition of inflation, but taking the wider view, very wrong. Inflation of basic things was subdued due to the ‘China effect’ and massive technological shift on-line which gave the impression of low inflation and prosperity but actually many prices went up – such as property assets, decent hotels, domestic services, fast cars and the like. The CPI numbers simply did not pick this up and it created a wealth illusion.

- Worse, lockdown. Lockdown was a policy choice and as I have and others have argued a catastrophic one. Britain had one of the most generous/delusional lockdowns in the world. Furlough, track and trace, bounce-back loans and more. The National Audit Office puts the direct cost at £376bn. That is almost certainly a significant underestimate due to the longer term impact on productivity, working patterns and cultural change, but let’s run with that low estimate. The unpalatable truth is the entire lockdown was funded with more QE – around £450bn more and continuing near-zero interest rates. This money went directly into the economy providing a further sugar rush.

- Lockdown unleashed supply chain problems, discouraged work and changed cultural norms. It also resulted in a massive transfer from the relatively productive private sector to the increasingly unproductive public one.

- This transfer was so great that before lockdown public spending was, according to the Office of Budgetary Responsibility (OBR) a still very high £887.7bn but for the latest available figures (2022-3) public spending grew to a staggering £1172bn, about £150bn more than inflation’s rise. Lockdown embedded spending in largely unproductive areas and has been a massive drag on the economy.

- This shift from the private to the public sector, which under Tony Blair, was around 35% of GDP is 47% today. No other advanced economy has grown its State so aggressively over that period. None.

- This wealth transfer to the State has been largely unproductive and is inflationary especially given the heavily unionised nature of much of the public sector while greatly increasing long term pension liabilities. It has also crowded out choice resulting in very mediocre public services.

- Hunt then blames Putin. Well of course the energy shock has been very great but in need not have been thus. The US is energy self-sufficient and has energy costs (gas and electricity) around half ours. The UK could easily have followed this lead given abundant energy assets locally. HMG chose instead to de-emphasise oil and gas and invest in renewables. Hunt makes a virtue out of this arguing this is part of the strategy to ‘half inflation.’ Really? Renewables are on no basis efficient, either in terms of reliability or price, hence the green levy on consumers. His statement arguing the dash to renewables will temper inflation is nonsense.

- Hunt then claims he’s taken the difficult step of ‘balancing the books.’ This is the biggest joke of all. Cameron inherited National Debt of £1015bn. Its £2516 bn today despite the highest taxes in 70 years. Public spending remains in structural growth funded by a depleted private sector. He makes no mention of this while spending remains very weakly controlled.

I could go on but frankly I don’t think I have ever seen such a dispiriting essay from any UK Chancellor as his pathetic video. Sure the car crash has been ten or fifteen years in the making but the primary exhibits of delusional monetary policy, excessive and largely unproductive public spending at the expensive of private enterprise, self-inflicted lockdown and an energy policy based on spin and wind and not what works is the real reason for the mess. He mentions not one of them.

The tragedy is our predicament is largely the Government’s own making and it is compounding the error. However, while I have zero confidence our current politicians will change tack the solution is really simple. It’s a solution that has worked the world over from Singapore to pre-Chinese Hong King from 1980’s Britain to 1980’s the US, from West Germany to Eastern Europe after the fall of communism.

So let’s start with a modest proposal. Let’s mandate to cut public spending by £100bn – that would leave spending still more than 10% higher than before the lockdown and recycle that into tax cuts (even so, taxes would still be higher than when Johnson took office.) Let’s harness our natural resources encouraging energy self-sufficiency, just as the US has done and secure the most basic need of all, heat and light, the very bedrock of any successful economy – and let’s hardness the voters wish for a more appropriately regulated economy not the ‘regulation central’ Whitehall has created.

Do this and we shall send a bright signal and quickly the UK shall start to re-generate and grow. Out of small acorns we can properly ‘build back better,’ based on individual desire and creativity not some Orwellian centralised planned regulatory dystopia.

If you If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City economist whose career has spanned over 30 years. He is director of Global Britain and a co-founder of Brexit-Watch.org.