By Ewen Stewart – 6 minute read

TODAY’S BUDGET misses the point. The wrong question is answered. The tax cuts are super, modest as they are in the context of recent rises, and should help at the margin – but the real question of how the UK re-creates its private sector dynamism requires a much more holistic and longer term answer, rather than the lame, micro-management measures of today.

Such a detailed and credible approach was missing, and is also missing from Labour, the likely, if only by default, beneficiaries of this self-inflicted decline.

The Budget was a poor and delusional show and underlines why the UK remains in dire trouble. A country divided, devoid of any tangible growth, or much hope, with short term political fixes generally centralising and distorting market approaches – all hollowing-out the longer term potential – this Budget does not move the dial.

Economically, the only thing going for the UK currently is its corporate assets are cheap by global standards. But they are cheap for a reason. The good ones will and are being acquired, for the rest, without a radical new approach, it is death by a thousand cuts. It’s fashionable to recommend an overweight focus in the UK on valuation grounds. Fair enough, but structurally, without a change of direction, longer term Britain is a big sell.

The UK should have extraordinary strategic advantage. It is the home of the English language, arguably has the most important city on the planet – being one of the world’s two top financial centres, uses superior common law principles, offers elite education, sport and unrivalled cultural assets, with many other leading centres of excellence.

More so, we are living through an extraordinary technological revolution which in many sectors, although not the public ones, is manifestly improving productivity. Critically too the UK is (or was) considered to be stable, enjoyed the rule of law which over centuries of turbulence elsewhere stood out. That was then.

So why is the UK performing so poorly?

The problem has been at least 25 years in the making, exacerbated for sure by very poor policy choices over the last five years, but simply put the UK has moved from a broadly free market economy 25 years ago to a highly-managed and regulation-driven state today.

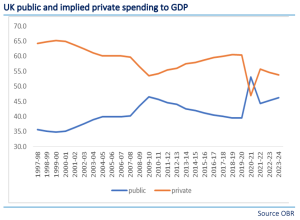

In 1997 the State accounted from broadly one third of the economy. Today it’s almost half.

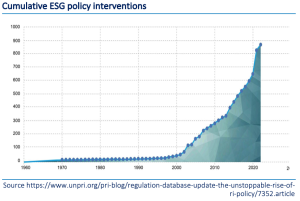

This in itself underestimates the problem as regulation (particularly in financial services, energy, employment law and the like) has increased exponentially, further undermining market responses. The UK is a post-free market economy. It is now Statist, centralised and controlled – and with it opportunity has withered.

As a result of this shift, which is not addressed at all by today’s Budget, the UK has become an ex-growth economy and one driven more by keeping close to the regulator, or government rather than by free enterprise.

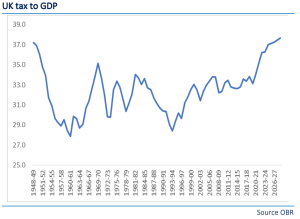

The three key charts highlighting the UK’s transition from a broadly free market economy to a centralised statist one are highlighted below, namely examining growth in public spending, tax and regulation. Perhaps the last of the three charts, on regulation, is the most extraordinary of all. Effectively the private sector’s decline mirrors public sector growth, with the latter crowding out the former and with it greatly undermining long term growth potential.

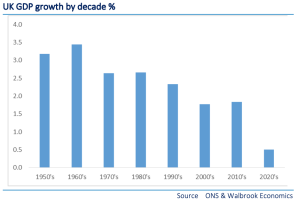

I would argue as a result of these policy choices growth has withered as outlined by the chart below which examines average annual growth per decade. It will be observed that growth is in structural decline.

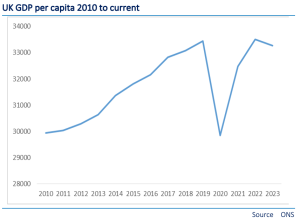

The above chart substantively overestimates GDP growth as it is a whole economy measure. With the population growing rapidly from previous near stability over the last 20 years, as a result of an effectively open borders policy, the more important measure is on a per capita basis (per head of population) and as can be seen from the chart below on this measure GDP is back to 2018 levels.

This stagnant performance is unprecedented and as far as we are aware is the weakest compound performance over six years in modern times i.e. over the last two hundred plus years.

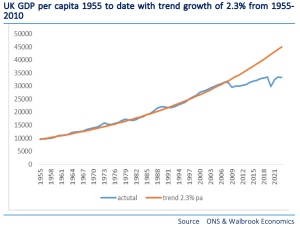

To put the scale of this failure in context from 1955 to 2010 per capita GDP growth averaged a very consistent 2.3%. Today, according to the ONS, per capita GDP stands at £33,271. If the long term trend growth had continued since 2010 current per capita GDP would be some 35% higher at £45,062. That is a staggering underperformance.

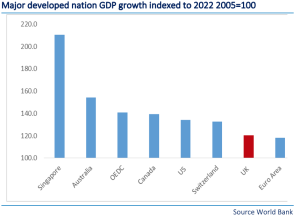

For those who think this is a developed economy phenomena think again. It’s a British and European problem. Other advanced economies notably the US, Australia, Canada and the OECD have all done markedly better performing not far off the UK growth average of between 1955-2010. This is outlined in the chart below. Decline is not inevitable. It’s a consequence of very poor policy choice.

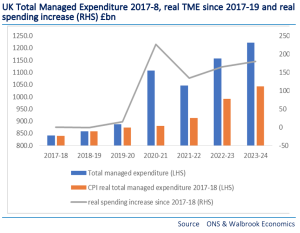

Today’s Budget misses the point – which is spending and regulation is out of control and this is crowding out the private sector. Since 2017-18 spending in real terms has increased by a staggering £179bn or by 21% from the base year. This is unprecedented in peace time and despite this, judging by polling evidence, public satisfaction with public services is, to put it mildly, poor.

This is a very concerning position, as while I suspect the likely next Chancellor, Rachael Reeves, will be constrained by an already very highly taxed and indebted economy with poor public sector outcomes the structural impediments to change are large; quangocracy, legal, diseconomies of scale, public sector quasi-monopolies, unions, media response etc. The system embeds and arguably rewards failure.

Public dissatisfaction is high but unfocused. Some believe, extraordinarily, that there has been austerity, others draw different conclusions. Most agree there is a major problem, but the mood is volatile which in itself risks poor policy response.

Rachael Reeves will need to be very careful. The tax burden is met by a tiny pool of people, many of whom may be mobile. The top 1% pay 27% of income tax and according to HMRC of the three million corporations filing a tax return only 57,000 file a profit of over £100k – less than fills Old Trafford most Saturdays – and just 4,255 companies reported a profit of over £1 million.

The tax base is thus very narrow, yet the people desire for more spending is often without reference to either the required enterprise or its cost. Without clear leadership, which currently seems lacking, these are exceptionally unstable times – but taxing more, as might be a change of Government’s desire, risks capital flight and would likely be highly counter-productive.

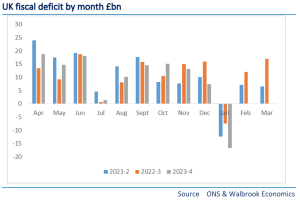

And despite the current record tax take the fiscal deficit remains dangerously embedded. £96.6bn borrowed year to date, broadly the same as last year’s £99.9bn at the same stage, and a likely annual deficit of some £120bn, or almost £5000 a household. This leaves almost no headroom for shocks which in a world of uncomfortable sabre-rattling, energy shocks and technical recession, is a very uncomfortable square indeed.

The reality is, unless forced by market imperative, the UK is locked into a tax and spend culture. If 14 years of Conservative rule have embedded this culture what chance then of a change for the better under Labour? More so, as now over half the population receive more in benefits than they pay in, the current debate is depressingly dominated by a consensus of tax, spend, regulate and centralise.

Worse the population is fractious, confused and upset, but not just for economic reasons. The country’s problems materially transcend mere economics. This will likely be a turbulent period for both the UK economy and politics.

While it would be relatively easy to turn this failing ship round – with supply side reforms; normalised public spending recycled into tax simplification and cuts; regulatory advantage, rather than the current regulation central; and a migration policy which was balanced and not destructive to either wages, services or housing affordability – in this political environment such an approach is, in the medium term, highly unlikely.

Until Government trusts the people and supports families, rather than seeking to control them it is hard to see a happy ending especially as the State appears mired in the management of decline.

If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City economist whose career has spanned over 30 years. He is director of Global Britain and a co-founder of Brexit-Watch.org.

By Simon Walker / No10 Downing Street – https://www.gov.uk/government/speeches/spring-budget-2023-speech image, OGL 3, https://commons.wikimedia.org/w/index.php?curid=129668123