By Catherine McBride – 6 minute read

IT HAS BEEN amusing to watch Jonathan Portes, Professor of Economics, Kings College London, hammering Mark Carney, now head of ESG investing at Brookfield Asset Management, for his inaccurate remark made during a Financial Times (FT) interview comparing UK and German GDPs since 2016. It was disingenuous for theformer Governor of the Bank of England to compare the UK economy exclusively with the German economy when they have very different dominant industries, international trade, and energy provision and then pretend the relative performance had something to do with Brexit. Ironically, arch-remainer Portes showed Carney was wrong in claiming that the UK economy had contracted to only 70% of the German level,

While it would be worth investigating how the UK managed to appoint a Bank of England Governor who doesn’t understand basic economics, or the politics behind Carney’s decision to exclusively compared the UK to Germany rather than to the whole of the EU or the Eurozone or even to France – surely, he wasn’t cherry-picking his miscalculated data? – I believe they both missed the most important point.

The two country’s economies are not comparable – they are apples and oranges. Manufacturing contributed 23.4% of German GVA but made up only 10% of the UK’s GVA in 2017. While according to the ONS the German service sector as a proportion of GDP was the lowest in the G7 at 68.7%, while the UK’s service sector was the highest at 79.2%. To suggest that only Brexit could possibly influence their relative economic performance, is at best amateurish and at worse deceitful.

It was the naïve belief that the UK and German economies must move in sync which led to the UK joining the European Exchange Rate Mechanism (ERM) and then to restrictive UK interest rates to force the synchronisation – and when that failed was followed by the UK being forced out of the ERM. The collateral damage to Britain’s finances and economy took years to repair. This finally meant the UK never joined the Euro, leaving the UK half in/half out of the European Union – which unsurprisingly led to Brexit.

Besides the clever cherry picking of markets by Carney – he also appears to have learnt something from Dominic Cummings with the now infamous number on the bus. Carney’s mistaken calculation has given his view (that Brexit has been bad for the UK economy) much greater publicity than an interview in the FT would usually do, especially as the FT is preaching to the converted when it comes to Brexit Bashing.

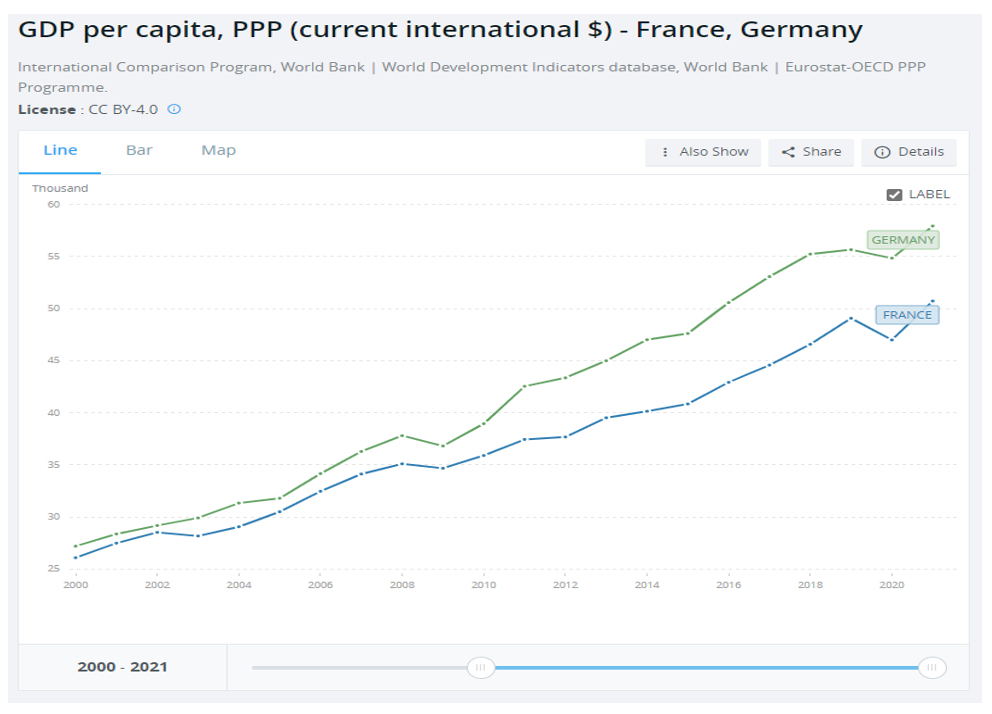

Carney could have compared the German economy with France and come to similar results, without needing to worry about the currency differential. According to the World Bank Website, since Germany and France joined the Euro, Germany has outperformed France in absolute GDP (PPP) and in GDP per capita, (PPP). (See chart below).But French economic underperformance to Germany, although it is a member of the EU and the eurozone, has never been a concern of the UK media.

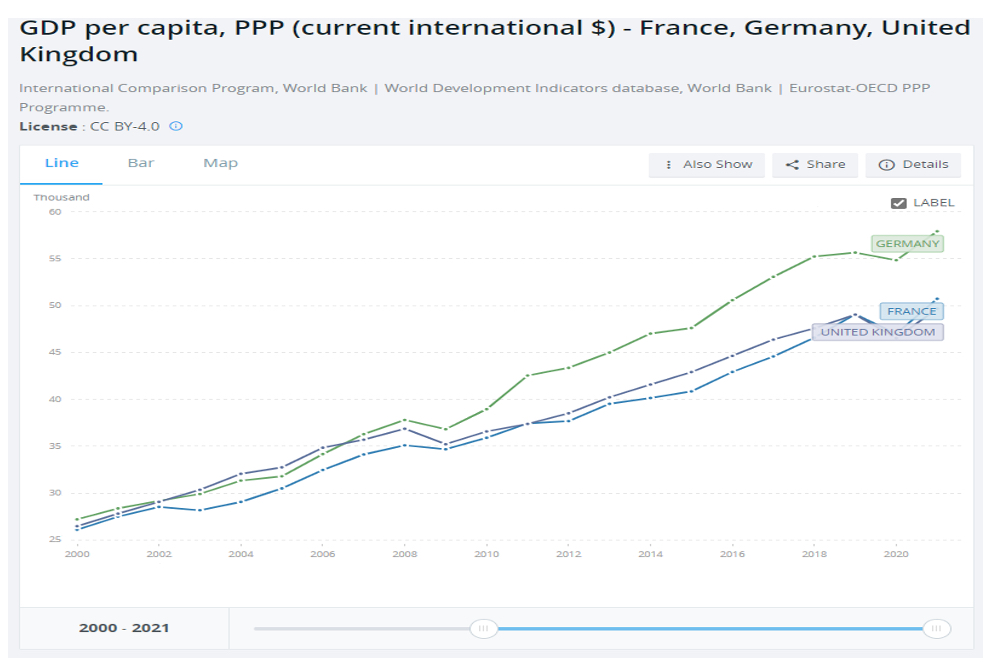

Add the UK to the World Bank’s GDP per capita graph and we see that the UK is now neck and neck with France, but pre-2008, when the UK financial services industry was stronger, the UK GDP per capita was closer to Germany. But again, does it matter? All three lines are roughly going from bottom left to upper right on the graph, with a Covid kink at the end. (See chart below)

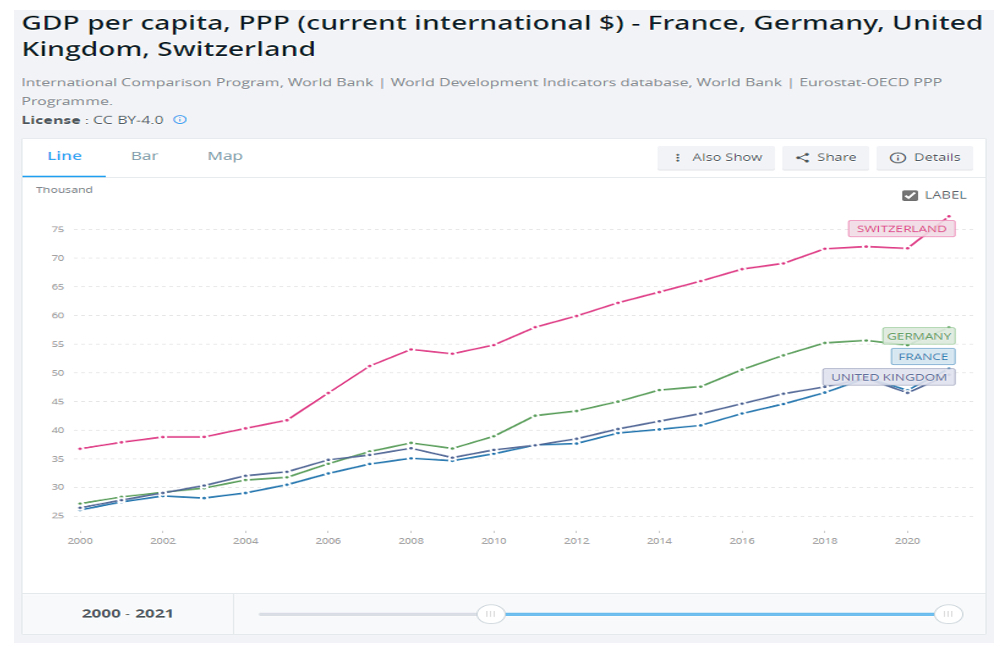

If I wanted to embarrass all three countries, I would add Switzerland to the chart and following Carney’s example, cite this as clear evidence that the EU doesn’t work, and all three countries should join EFTA instead. (See chart below)

The Bigger picture – International trade

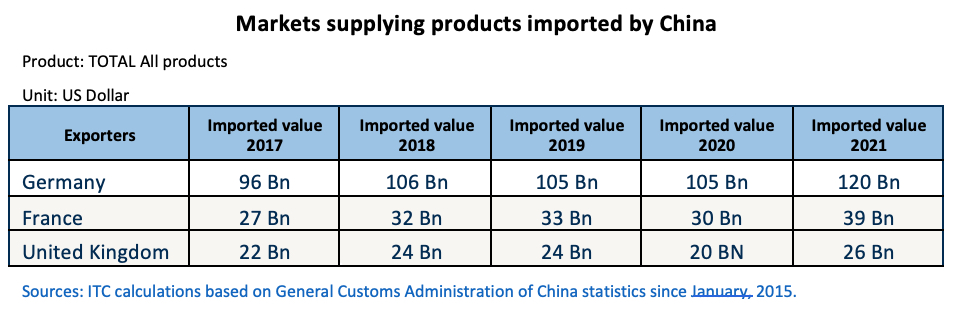

If anything, Germany’s GDP per capita began to diverge from the UK’s not in 2016, as Carney would like us to think, but as long ago as 2009. Germany seems to have avoided the worse of the Global Financial Crisis caused by the American subprime mortgage market collapse. This is probably due to its relatively smaller financial service sector. But that may also be merely coincidental with other external factors outside the EU. For 2008 was the year when China began to make its presence felt, not just as a producer of low-cost goods but also as a consumer of Germany’s high-end manufacturing products. And although France ($39b exports to China in 2021) and the UK ($26b) also sell to China, German exports are an order of magnitude larger at $120 billion. And this isn’t a one-off event as the chart below shows. But it is easier for Carney to Blame Brexit.

Of course, all this is likely to change as China develops the capability to build its own machinery without involving Germany and when possibly more Chinese can afford to buy French wine or British insurance. Then Germany might sink back to the GDP per capita level of France and the UK.

The engine of enterprise – cheap, plentiful, consistent energy

But other things have benefited German manufacturing besides having a willing export market in China. Nord Stream I opened in 2012, providing Germany with even more cheap Russian gas. Russian gas was not new to Germany – even when the Berlin Wall came down Russia was supplying a third of West German gas. But it does appear that just as Germany’s industry was expanding with ample Russian gas after 2012, the UK moved into its self-flagellation days. Instead of cutting the ‘Green Crap’ as Cameron had promised, the government expanded reliance on wind power and banned fracking while new nuclear power stations seem still to be a long way away. So, while German energy became cheaper and more plentiful, UK energy became more expensive and less reliable. This is perhaps another cause of the differential between the two countries GDPs, and not Brexit. The UK conversion to Green power sources has been a large drain on the economy and has coincided with the UKs GDP divergence from Germany. According to the ONS, electricity generated from wind power in the UK has increased by 715% from 2009 to 2020.

Yes, Germany has outperformed the UK and France since 2009. But will this continue? The German Think tank, IFO Institute thinks not. They are predicting German GDP to fall by €64bn or 1.8% due to high energy prices pushing manufacturing out of Germany. But the canny Germans are going back to coal, which is generally cheaper than gas, so they may still outperform the UK.

It seems unlikely the UK will ever rebalance its economy away from services and back to manufacturing, especially if we are relying on imported fracked gas from the US that has been liquefied, transported across the Atlantic and then converted back to gas, all at much greater cost than using our own gas reserves.

Let’s hope Portes and Carney will soon debate which economy saw the greatest GDP contraction from its Net Zero commitments. Mr Carney is still the co-chair of Glasgow Financial Alliance for Net Zero – so that debate would be a humdinger.

If you If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Catherine McBride is an economist who writes about trade and agriculture. She is on the Government’s Trade and Agriculture Commission and is a fellow of the Centre for Brexit Policy.

Photo of Mark Carney via Wikimedia commons