By Ewen Stewart – 7 minute read

BRITAIN SHOULD BE BOOMING. Our economy is structurally biased to globally growing industries from financial and professional services to elite education, from media and cultural assets to racing cars, from bio and medical technology to logistics, from niche engineering to tourism. These are all industries growing more rapidly than most. Britain should be a beacon of success. Patently it is not.

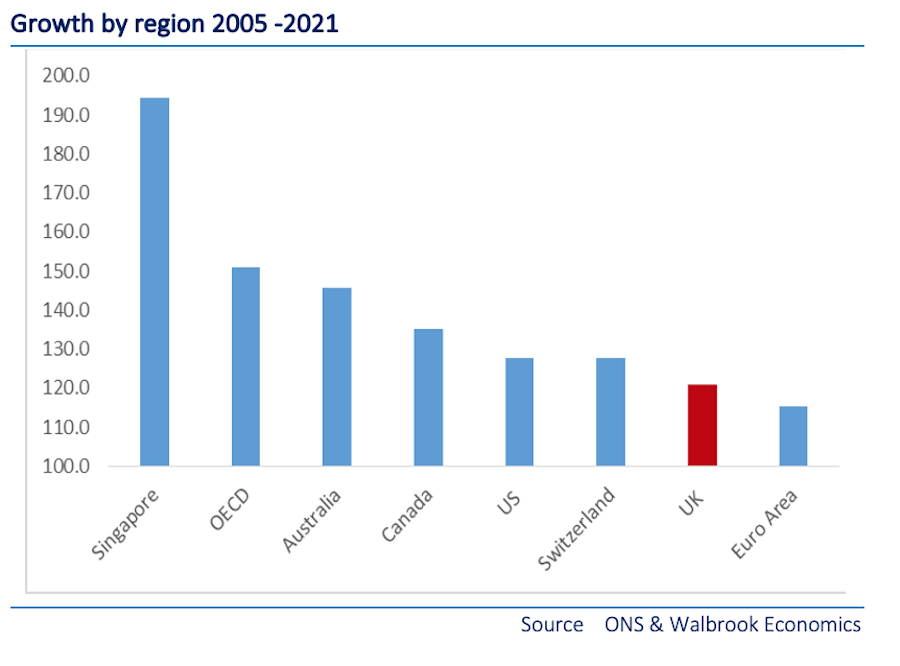

Relative to the Eurozone over the last 20-odd years the UK’s growth performance may have been credible, but compared to other advanced markets it is deeply uninspiring as is indicated by the chart below. This is not so much a case of advanced nation stagnation and developed world catch-up, but more a case of economic failure across the continent of Europe, the UK included.

Worse, the UK’s so-called competitive advantages of fairly low and stable tax, modest regulation, political stability through the rule of law and absence from arbitrary judgement has either been lost, or severely undermined. The political clock is also ticking with a further shift to tax, spend and regulate highly likely post the next general election, just two years away.

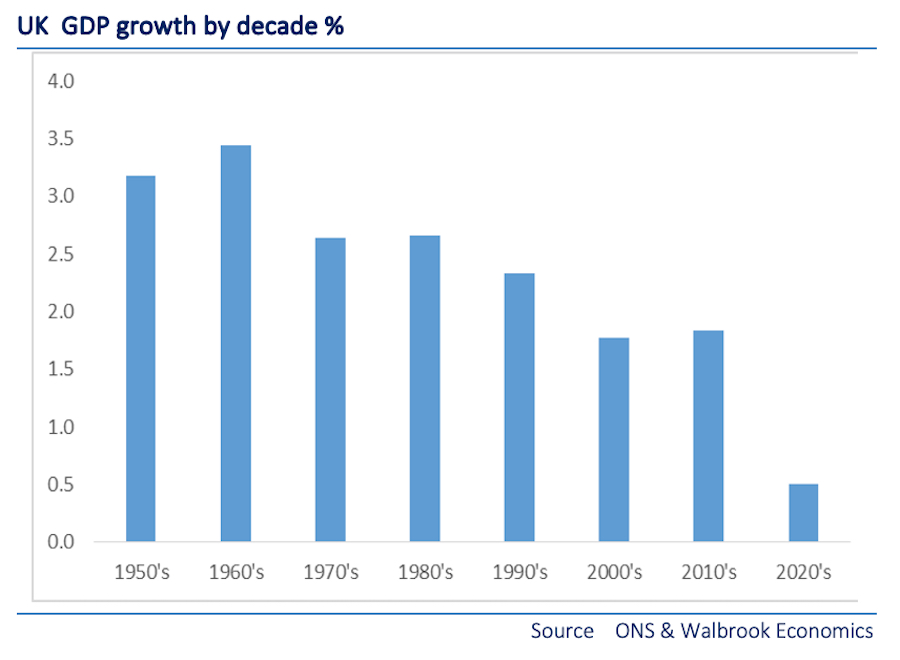

The problem is not a new one. It dates all the way back to the roaring 1960’s. Indeed as the chart below shows UK growth has been in long term structural decline. Much has been made of current comparisons with the strike-ridden 1970’s. Sure, ‘Smash,’ corned beef and instant coffee may have given way to guacamole, sushi and flat white, but at least the 1970’s were a decade of decent economic growth. The 2020’s looks like being trouble and union strife but without the growth.

The question is more perplexing because we are living through a period of extraordinary technological advancement with huge potential productivity gains which in theory should advance growth, not subtract it. So what’s going on?

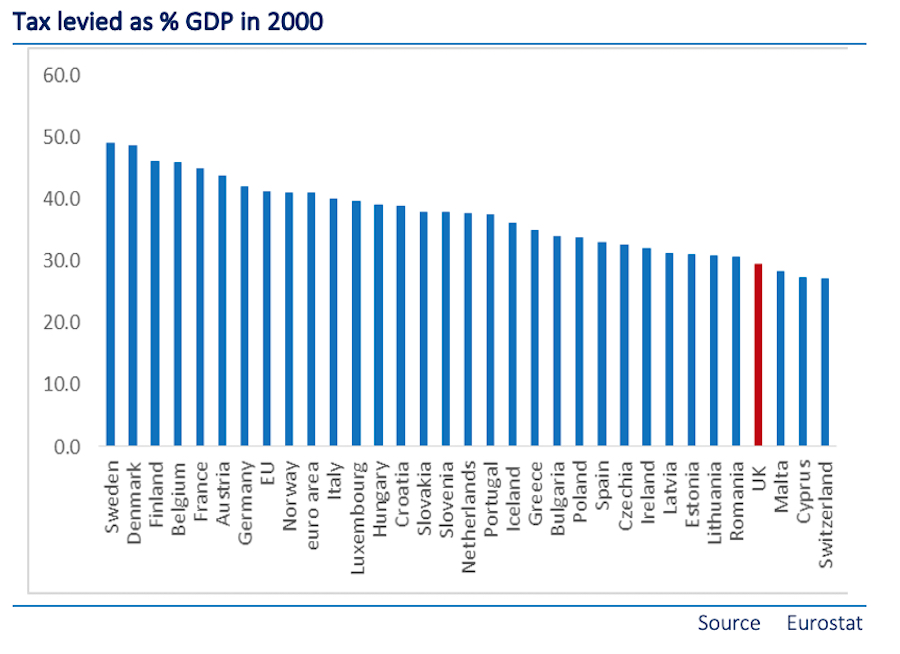

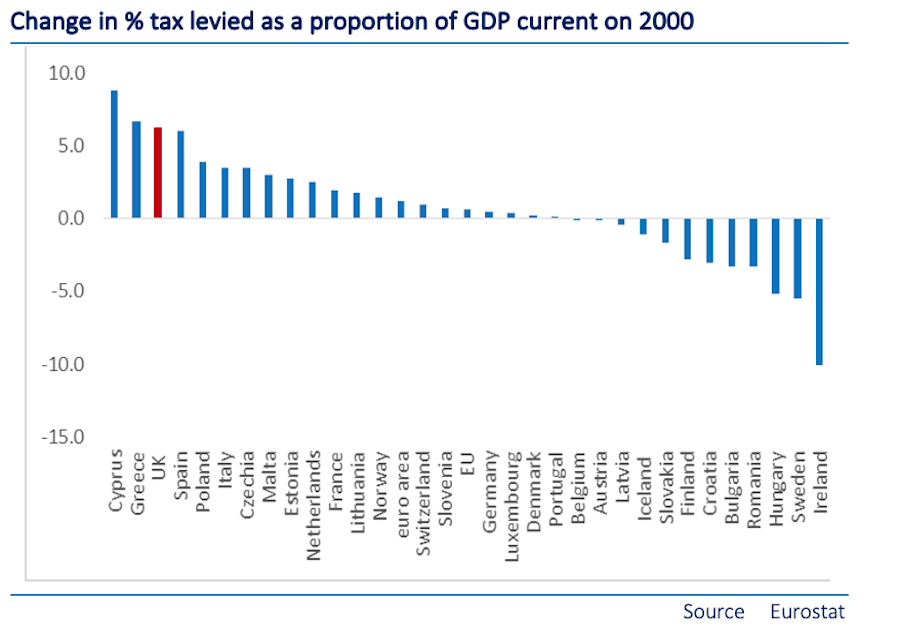

As the world celebrated a new Millennium Cool Britannia seemed a pretty good place. It was certainly a competitive place as demonstrated by the low tax environment outlined in the chart below. Little wonder with apparent political stability, the rule of law and a myriad of soft power assets the UK was perceived as an attractive place to invest.

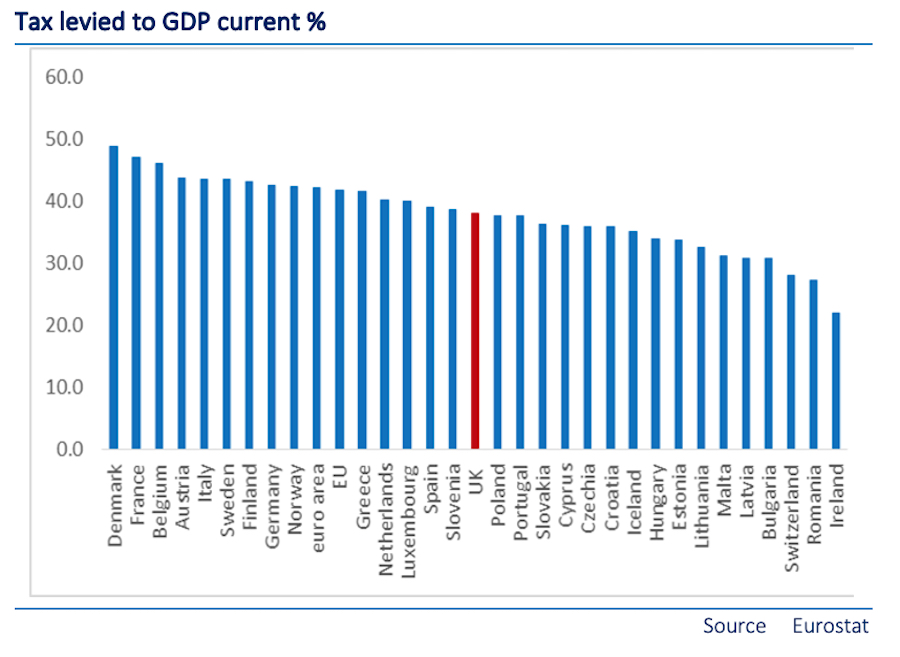

Fast forward to today and the UK has moved from being a leader in tax competitiveness to, well, a very average ranking – and getting worse. Certainly the clear tax advantage the UK had has gone with ‘the arbitrage’ on other major European countries now minimal.

More importantly, however, the UK has seen by far and away the greatest increase in the tax rate of any significant European country, Cyprus and Greece excepted as outlined by the chart below. Indeed the UK has been markedly raising tax while others, including Ireland and Sweden – who have both done far better – have been moving strongly in the opposite direction. Are any British public services any better for all this extra tax?

Tax is only part of the equation. While I accept regulation is harder to quantify and more subjective as a matter of political choice, the UK has become the regulation hub of Europe, in direct contempt of the instructions of the people who voted to leave the EU partially to get Big Government off our backs.

In terms of net zero the UK approach is the most extreme and prescriptive of any country on earth, as far as I can see, even though what steps the UK takes makes the square root of almost zero difference, given Britain accounts for less than 1% of global emissions.

Equally, in terms of ESG (Environmental, Social and Governance) the UK has taken a more draconian position than Brussels, replacing the simple prosperity motive with a myriad of complex and often contradictory goals clearly adding cost and undermining the country’s competitive position.

A third attraction of the UK was its relative political stability, rule of law and non-arbitrary taxation. In this regard the UK has also become significantly less attractive. Four Prime Ministers in as many years is hardly stable.

Moreover, the attack on property rights, the impact of Government intervention in the labour and educational markets and the risk of future wealth taxes creates an environment of increasing uncertainty. Worse, all the direction is further leftwards of tax, spend, control and regulate.

The bottom line is the UK’s relative competitive position has undoubtedly deteriorated and on current trends looks likely to do so further. With the top 1% of earners paying 27% of all income taxes such a loss of competitiveness is a dangerous strategy for governments, particularly with a fiscal deficit (government borrowing) likely to exceed £200bn pa.

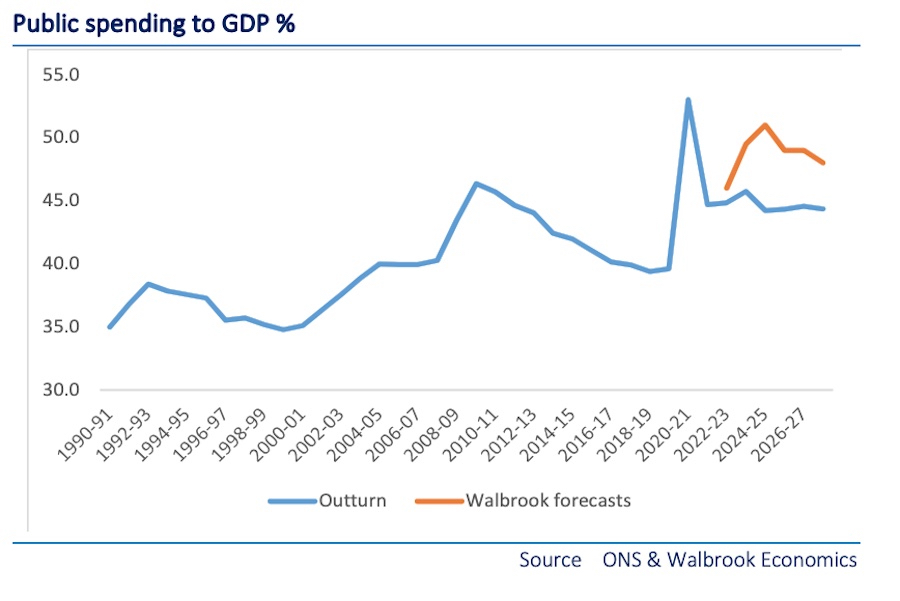

As Britain’s opportunity has declined the Public Sector has grown to become the overwhelmingly important economic actor in the UK economy. In the early 1990’s public spending accounted for 35% of GDP. It peaked in 2020-21 at 52% of GDP as a consequence of lockdowns. This is the Big State without the Swedish service to match. It’s a lose, lose.

As can be seen from the chart below, the OBR estimates public spending is currently embedded at around 43% GDP, proportionately 22% more than the early 1990’s. This is likely to be an underestimate, as public spending tends to be pro-cyclical in a recession. Our central forecast is that the state is embedded at just under 50% of GDP, a level unprecedented for the UK in peacetime.

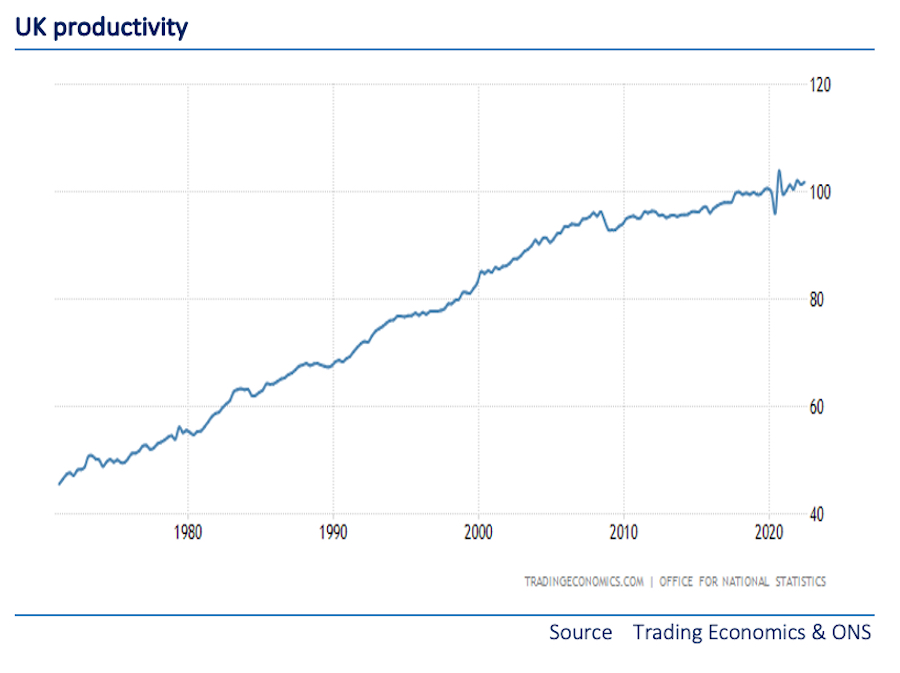

The chart below examines the ONS view of UK productivity growth from the early 1980’s. Long term trend growth, in excess of 2%, which had been pretty consistent since the industrial revolution, has faltered since the Global Financial Crisis, stagnating at a volatile rate of somewhat sub-1% pa.

Such a mediocre performance is somewhat counterintuitive as we live in an age of unprecedented technological advance in most fields. This should have turbo-charged growth.

While there are a number of factors behind this poor performance, including a decade of central bank intervention keeping economically dead businesses alive, the overwhelming factor is the extraordinarily poor bang for the public sector buck.

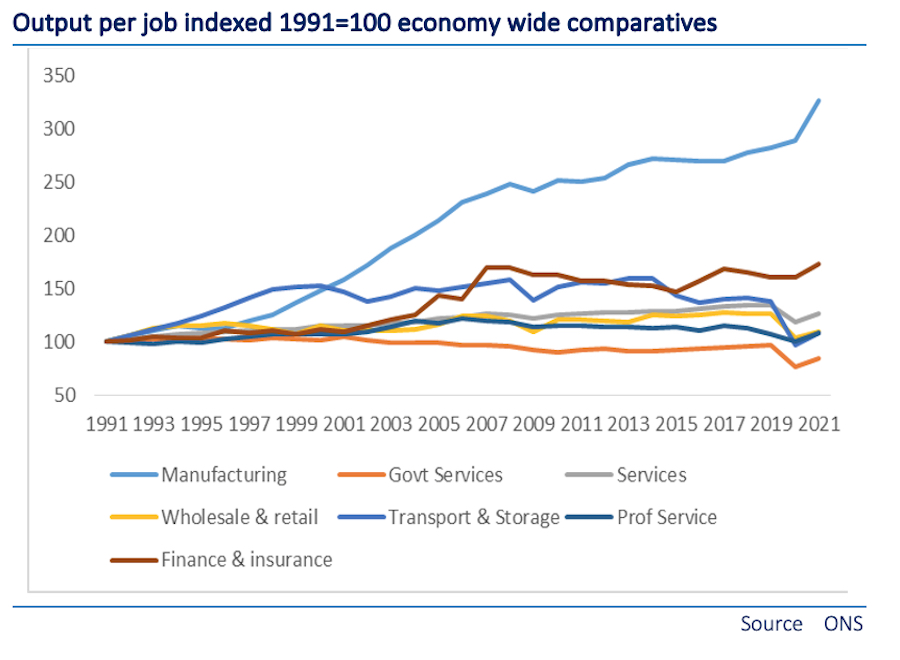

The ONS provides long term series examining ‘output per job.’ The chart below, looking at key broad sectors, indexed to 1991, indicates a wide variance in output per job by sector with manufacturing leading the way by increasing productivity by a factor of 3.2x over that period. The financial sector increased output per job by 72% and professional services by a more modest 7%.

This contrasts greatly with Government Services sector which was the only sector to see productivity decline over the control period, falling by some 16%, as measured by output per job in 2021 compared with 1991. This productivity decline has been consistent over many years but the rate of decline has increased markedly since 2019, just at the time when the magnitude of public spending increased materially. This decline can be partly, but not wholly, explained by lockdown.

The government services performance is extraordinary as the 1991 economy was pre-digital, which should have given an immense opportunity for productivity gain. One would have expected public service performance to be much more closely in line with the private service sector which saw a 26% improvement in productivity over that period.

The bottom line is rather than encouraging enterprise and growth, which would in turn support the tax base, the UK political establishment have captured the nation. This blob has controlled almost every aspect of economic activity – either directly through spending, or indirectly through grossly excessive regulation and control – and rather unsurprisingly they are neither any good at managing economic growth, nor understand how success is created.

Through their control to meet social objectives, not outlined in any manifesto I can recall seeing, they are slowly crushing the enterprise of this nation and with it they are levelling down, which inevitably will impoverish us.

Next year I shall write a series of essays on how this could rather easily be turned around, if there was the political determination so to do. The ideas I will outline are not radical. They are tried and tested from rebuilding basket case Britain in the 1980’s to the extraordinary success of Hong Kong and Singapore – from post-Soviet Eastern Europe to defeated West Germany post 1945.

The problem is the political establishment with their extraordinarily low expectations, short-termism, expediency and social engineering.

Their interests and loyalties lie not at home but far beyond these shores. We won the Brexit battle but the message has been deliberately neutered and the opportunities suppressed.

Now we must win the global battle and regain our freedom to act in a moderate and proportionate fashion, trusting the people as our core principle – for the people always no better than any Big Government.

If you If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City Economist whose career has spanned over 30 years. He is Director of Global Britain and his work is widely published in economics and political journals.

Image by ~ Bitter ~ from Adobe Stock