By Ewen Stewart – 6 minute read

JEREMY HUNT’S latest Budget misses the point and does not address the underlying declining competitiveness of the UK economy. It fails to address the root of the problem; substantial excess public spending, extraordinarily weak public sector productivity and a subsequent loss of tax competitiveness with more micro-management and a big spending- high tax status quo.

Over the last 20 years the UK has swapped a largely private enterprise economy for the managed state economy and with it the UK looks set to materially under-perform the G20 in both the short and medium term. For a country dependent on global investment this is a worrying square.

In a global context UK assets have been de-rated and are broadly inexpensive relative to many other markets, but as capital market valuations are largely made globally and not domestically it is not obvious as to where substantive net new investment will emanate from in this environment. The Budget is therefore a missed opportunity.

This loss of relative UK competitiveness is multifaceted and has been ongoing gradually over the last 20 years. It has now reached an inflection point which presents a material risk of accelerating negative capital flows. Why would FDI come to the UK when the relative attractiveness of the market has declined so materially and with growing political risk?

The primary reasons why I see the UK economy is increasing structurally challenged include:

- A significant undermining of the UK’s tax competitiveness in both the corporate and personal spheres relative to the EU;

- A substantial shift in the balance of the private and public sector scale over the last 20 years (the state as a proportion of GDP increasing from 35% in 2000 to 47% today – negatively impacting underlying productivity and growth potential) resulting in the State becoming the overwhelmingly important actor;

- A quantum increase in regulation adding to cost with UK regulation generally exceeding EU and other comparable global markets;

- Poorly defined energy security policy; and,

- An undermining of global perceptions of UK governance and stability given political risk and policy shifts.

Unfortunately, this latest Budget simply turns a Nelsonian eye to these issues which, outside welcome pension reform, offers little of positive of substance.

Context is important

20 years ago, Britain could claim with justification the State was modestly sized by European standards, its taxes were amongst the lowest in Europe and there was a high degree of confidence in both the rule of law and what could be described as regulatory proportionality and visibility. As a result, the UK was consistently the top European destination for investment.

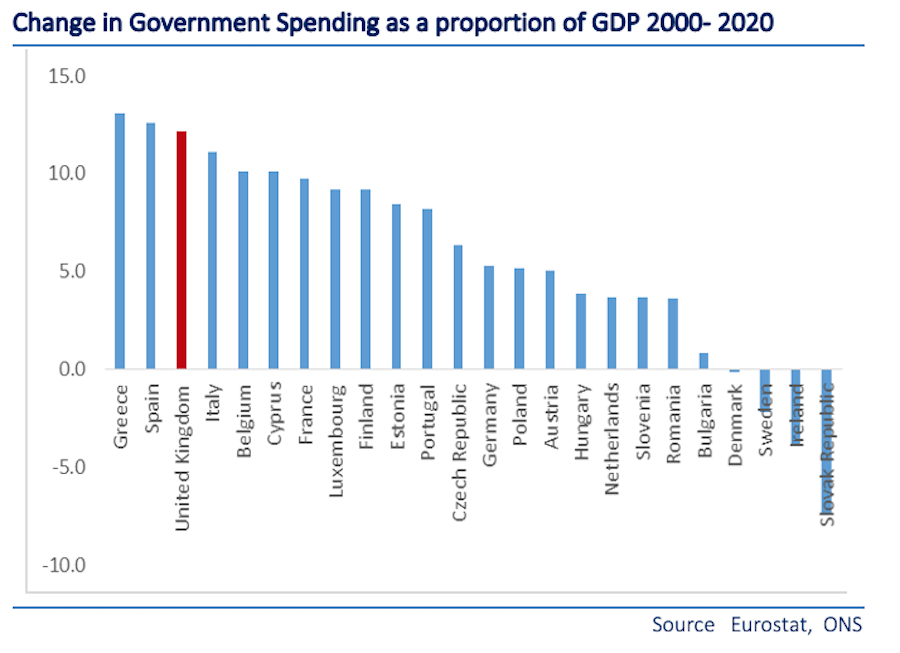

Fast forward to today and those strategic advantages have gone. If we compare the change in the proportion of public spending to GDP over the last 20 years with the exceptions of Greece and Spain no European country has seen such an expansion of the State. (from 35% in 2000 to 47% today)

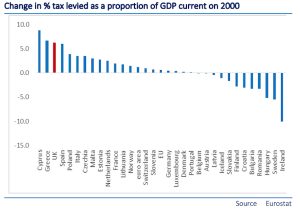

As a result, taxes have risen markedly. Only Cyprus (from a very low base) and Greece have increased tax more than the UK and the relative contrast with two of Europe’s most successful economies Sweden and Ireland could not be starker as outlined by the chart below.

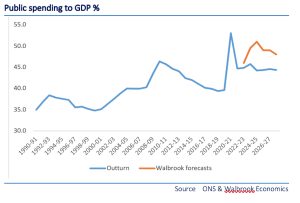

Again, examining the chart below looking at public spending and a proportion of GDP since 1990 we can see that the UK has become increasingly dependent on the state. As shall be demonstrated later however, this increase in spending has not been matched by improved productivity.

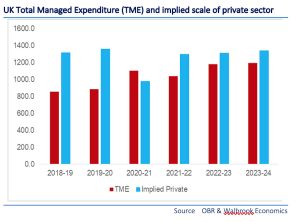

Moreover, while the economy might well escape recession this year it is not down to private sector growth but increased public spending, as can be seen by the chart below. Indeed, private sector scale remains below pre lockdown levels and will likely only exceed 2019-20 levels in 2024-5. This bodes very poorly for the medium term.

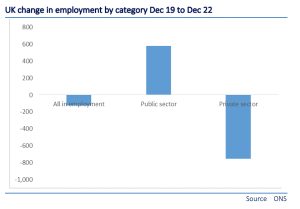

The decline of the private sector scale is mirrored by the decline in private sector employment. Since the eve of lockdown, as outlined by the chart below, the private sector has shed over 750,000 jobs with the public sector picking up a net 600,000.

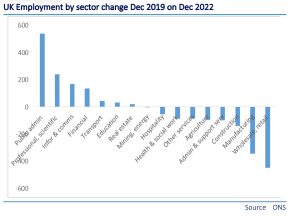

The chart below outlines employment change by sector since the eve of lockdown with material employment reductions in retail and wholesale, manufacturing and construction with public administration taking up most of the slack.

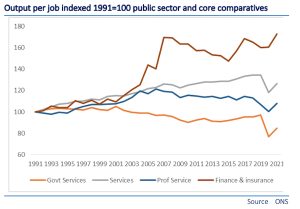

Unfortunately, examining ONS data on output per job, public sector productivity continues to materially lag the private sector with the latter’s productivity now lower than in 1991. Given the technological advances over the period that is truly extraordinary. There is no mention at all of this in today’s budget. The evidence suggests much of the UK’s poor productivity performance can simply be explained by the shift from private to public spheres.

In a European context no major economy has changed as dramatically as the UK economy over the last 20 years – with the UK not just converging towards European averages on public spending and tax but exceeding them in terms of regulation – ensuring a large part of the UK’s global investment case is gone. For a country largely dependent on global capital flows the political choices could hardly have been much poorer, and consistently so.

Hunt’s Budget has no beef

Jeremy Hunt’s budget simply ignores these material issues. Indeed, it utterly fails to even acknowledge them. Public spending will continue to rise and there is no apparent strategy for closing the productivity gap. Tax changes are minimal and the previously flagged increase in corporation tax sends a clear signal to global investors. What has been a trickle of capital exodus risks becoming a flood.

One cheer for pensions, for sure, but outside that micromanagement on free nursery places, complication of alcohol taxes (so draught beer goes down and port up), there are no tax incentives to encourage work, no attempt to address energy security, the confirmation of a substantial and likely counter-productive increase in corporation tax and no attempt to simplify regulation.

Outside Russia and Taiwan, the UK is currently the weakest performing economy in the G20. CRH is leaving London for New York and ARM, perhaps one of the UK’s most successful tech companies is also shunning London with a $50bn float in the US.

The warning signs are there from CRH to Arm, Dyson’s concerns to Astra Zeneca building a new pharmaceutical plant in Ireland rather than the UK. Hunt may boast a recession has been avoided but under the apparent calm lies a declining private sector and the embryos of capital flight.

I am sorry to say this budget not only misses the point, it doesn’t understand it.

If you If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City economist whose career has spanned over 30 years. He is director of Global Britain and a co-founder of Brexit-Watch.org.