By Ewen Stewart – 7 minute read

WE FACE A CRISIS born out of serial material errors over many years and short-term fixes designed to kick the can down the road. Today’s Autumn Statement compounds the error.

It not only raises taxes to an unprecedented peace time level but it fails utterly to address the fundamental problem of far too much Government, far too much regulation and a dreadful bang for the buck. Rather than spending cuts, spending will actually continue to increase in real terms!

Hunt smirks with pride as he says public spending will rise – 1% in real terms in each of the next five years – with the private sector paying the price. Moreso, Hunt stands there without a hint of irony and says ‘as Conservative we do not leave debt to the next generation.’

He is either very poorly advised, or somewhat forgetful, as he may recall Cameron inherited a National Debt of £821bn. It is £2434bn today, a tripling in just 12 years. That’s the Conservative legacy: massive debt, massive tax and shocking locked-down public service.

We live in an age of extraordinary innovation; medical, scientific and technological. We should be in clover. The fact we are not is entirely the fault of our political establishment. The failure is economic, moral and cultural but from an economic perspective it is primarily four-fold, and you will note the ‘B word’ is entirely absent and irrelevant to the malaise.

Exhibit One: The delusion of free money – and the absolute failure of central banks to normalise monetary policy in the decade when they had the chance, post the Global Financial Crisis. This policy broke the link between tax and spend enabling Governments to spend with impunity forgetting that free money, and QE were unprecedented in the 300-year history of the Bank of England, with no Plan B to unwind.

Exhibit Two: Net zero. The cancellation of carbon, the very basis for the industrial revolution, with a currently cost ineffective, unproven alternative which breaks every rule of economics. All previous revolutions were market driven. The car replaced the horse because it was better and ultimately more cost effective, net zero is based on virtue signalling without regard to cost or even certain reliability. No sane policy is based without knowing what the implications will be and no major technology transfer has ever happened before without a market-based proven alternative.

Exhibit Three: Lockdown. £500bn wasted on furlough, bounce back loans, track and trace, and the like – extending the free money QE delusion, weakening the productive private sector and causing all sorts of negative side effects from rising mental health issues to lengthening hospital waiting lists, from 18% of school children still not turning up to school to shortages and economic inactivity. It has uprooted society and created serious long-term problems, not least contributing to inflation.

Exhibit Four: War in Ukraine – arguably the only one that is not self-inflicted; with its tragic consequences and impact on energy prices but which exposed our poor gas reserves and unwillingness to commit to fracking.

Our establishment of politicians and technocrats have utterly failed us. They have failed to address the uncontrolled and grossly inefficient level of public spending, they have failed to incentivise the growth engine, the private sector, with further dispiriting tax rises, taking tax to the highest level since war-torn 1948. They have failed to provide any vison of hope.

The scale of the tax rises is staggering, as is outlined in the chart below. From a low of 28% of GDP in 1993, taxes will have increased to 37% of GDP by 2027, a 40% real terms rise. Is our education better, or health, or police force? Is the army and navy bigger? Are we less regulated and able to go about our business unhindered? In fact, what exactly is there to show for this staggering rise?

Frankly, this Government’s actions are far more extreme than Jeremy Corbyn promised in 2019.

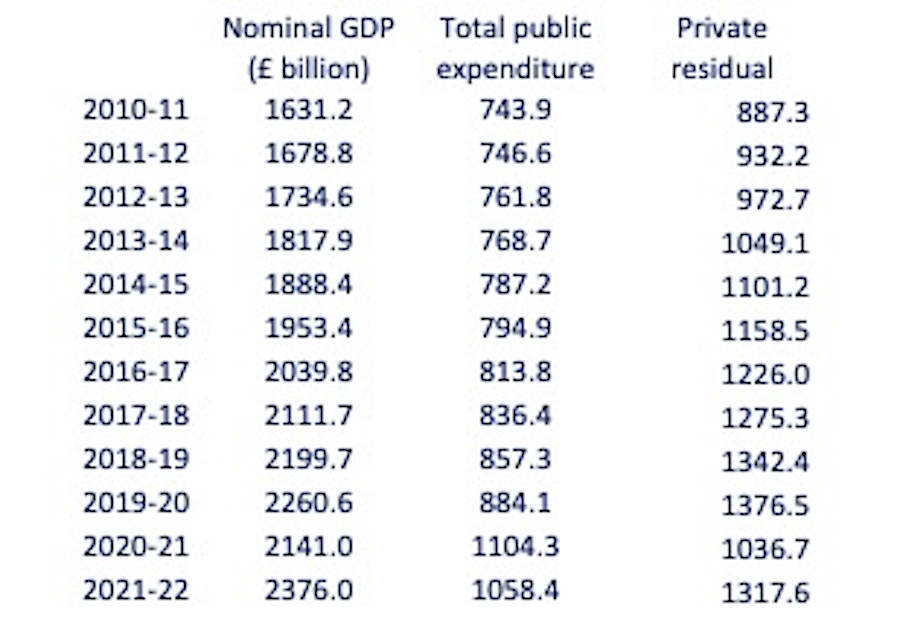

Tax as a proportion of GDP was 32.9% then, it will be 37% by 2027. A far higher increase than Corbyn ever proposed. Public spending was £884bn in 2019 but it will be £1100bn next year and inflation was 1.5% in 2019. Some record.

This Government has no excuses. It had an 80-seat majority. Johnson blew it with economically illiterate decisions backed up by a central bank which was frankly incapable of seeing that monetary experimentation should at most have been an emergency measure, not a twelve-year jolly.

Inexcusable though, is the inability to control the growth of the state. The table below demonstrates how embedded public spending is. A 25% increase in public spending over lockdown of which 80% has stuck as the economy has opened up.

Despite this Hunt can find nothing to cut.

Spending will continue to rise in real terms each and every year and in some cases (NHS and education) materially.

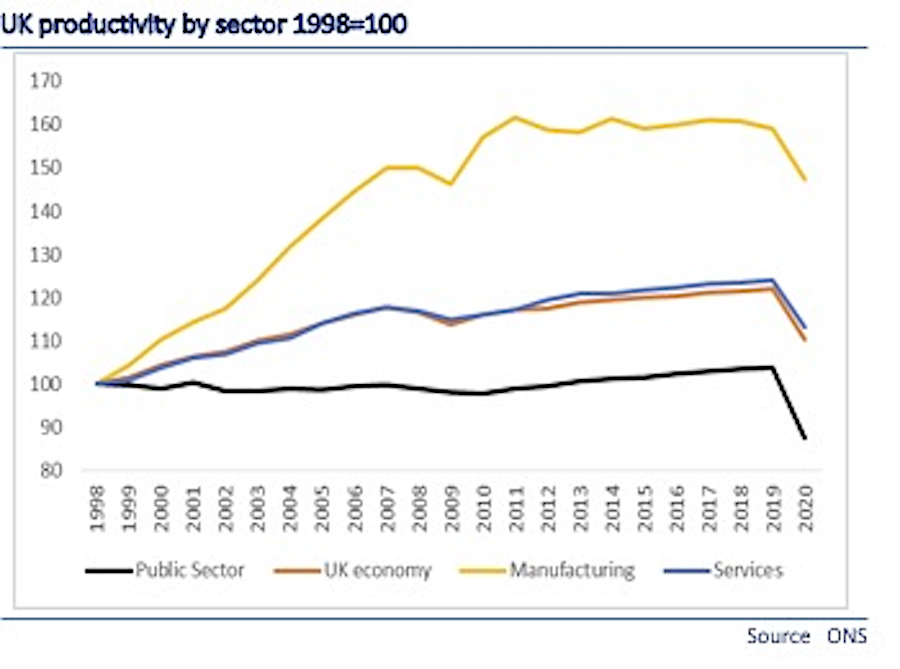

And the bang for the buck is outlined below. Public sector productivity is lower than in 1998 despite all the technological advances there have been.

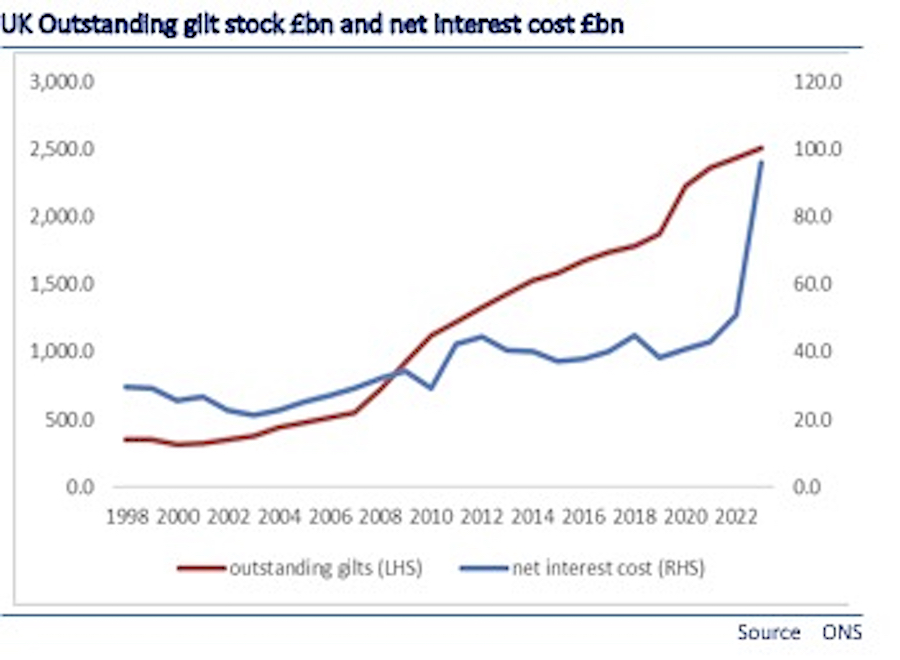

But this is just the start. The real ticking time bomb is the accumulated public debt. As can be seen from the chart below the cost of servicing all that Government debt barely changed between 1998 and 2020 as the cost of borrowing compressed and debt went up five-fold. What a wheeze.

Now though with inflation at 11.1% and gilts yielding 3% the cost of servicing that debt will likely go from £40bn to £105bn by next year, an increase of greater than the entire defence budget.

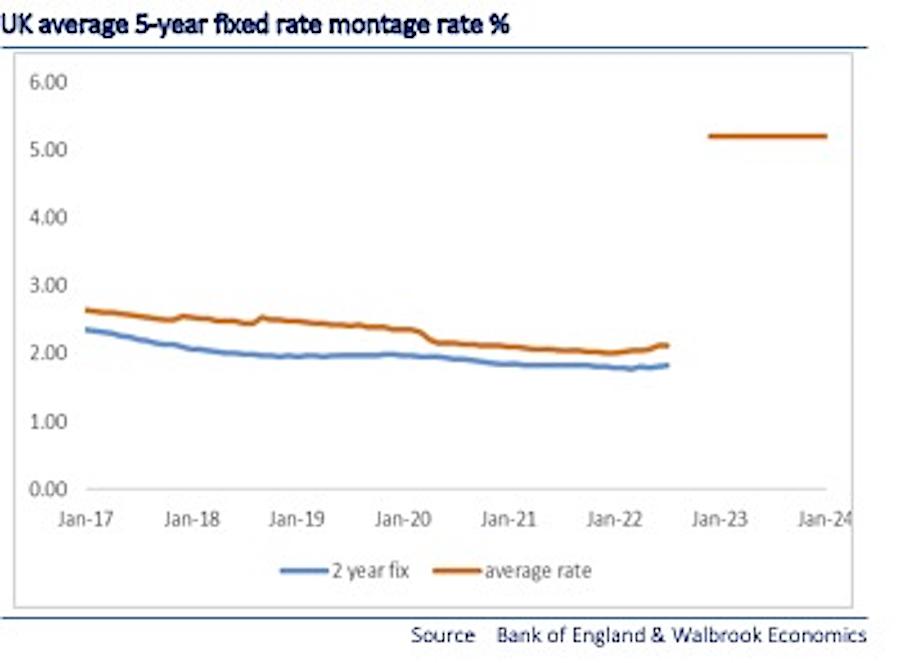

So as the economy moves into recession as the cost of debt escalates this Government tightens by £50bn, or 2% GDP. (As an example a five-year fixed rate mortgage cost 2.3% typically a few months ago is now around 5.2% today – dwarfing the more-than-doubling of energy costs – see chart below.) The seeds are tragically sown for a major recession. Today’s budget is counter-productive undermining confidence and rewarding failure. It will further undermine the public finances, risking yet more tax rises – and so it goes on.

No one is saying, given the mess they have created, a recovery strategy is easy. It is not. While unfunded tax cuts on a large scale are not credible what would have been credible would have been to pare back spending to pre-pandemic levels in real terms. Taking spending back to 2019 levels is hardly a big ask.

Given the technological age we live in, efficiency savings should be material. Spending should be falling as a proportion of GDP, not rising, and it could be with sensible controls and a re-assessment of what the state does. Are we really to believe spending is a one-way ratchet, only up? That is what this cravenly cowardly Conservative Party seems to believe.

But there is another way. Failed economies can recovery and can recover very quickly. Look at the great success if Eastern Europe after the tragedy of 70 years of Marxism. Unleash the people and they will innovate, trade and prosper.

Despite appalling governance Britain still possess numerous world class assets, from financial services to business and professional services. From soft assets like sport, culture and media to logistics and distribution. From precision engineering to biotech and pharmaceuticals and from whisky to elite education. The list goes on. All our excellence is in the private sector, precious little is anywhere near Government perhaps outside the regiments of the line (or what is left of them).

So, what to do? Besides cancelling HS2 and other similar vanity projects, which is an easy win, over £100bn of public spending normalisation should be the simple starter. This merely takes real spending back to the eve of lockdown. Hardly a big ask and something to build on.

This could have funded tax cuts focused on a genuine growth strategy. Reshape the state merely back to 2019 levels and instead of tax rising to 37% of GDP it could have fallen back to 33%. Again, this is very modest – simply the pre-lockdown level and far higher than under even Tony Blair.

That signal of intent would have single-handedly lifted the pall of depression over the land. It would have given hope and created a base to build on. It would have stimulated growth and lessened the pain of rising interest rates. Sure, the next eighteen months or so would still have been tough but recovery would have been swift. That really is the only option left to Britain. The approach of tax, spend and waste is the road to ruin.

Sooner or later there will be no option but to bite the bullet and change direction.

If you If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City Economist whose career has spanned over 30 years. He is Director of Global Britain and his work is widely published in economics and political journals.