By Ewen Stewart – 6 minute read

MUCH HAS BEEN WRITTEN about the Budget. Justifiably almost none of it good. It would be easy to pick fault with the poor record of the Office of Budget Responsibility (OBR) in modelling the UK economy, but LSE Professor and OBR member David Miles does a good job of explaining why they always get it wrong and it would be more useful if I address the question “Are the OBR’s assumptions reasonable?”

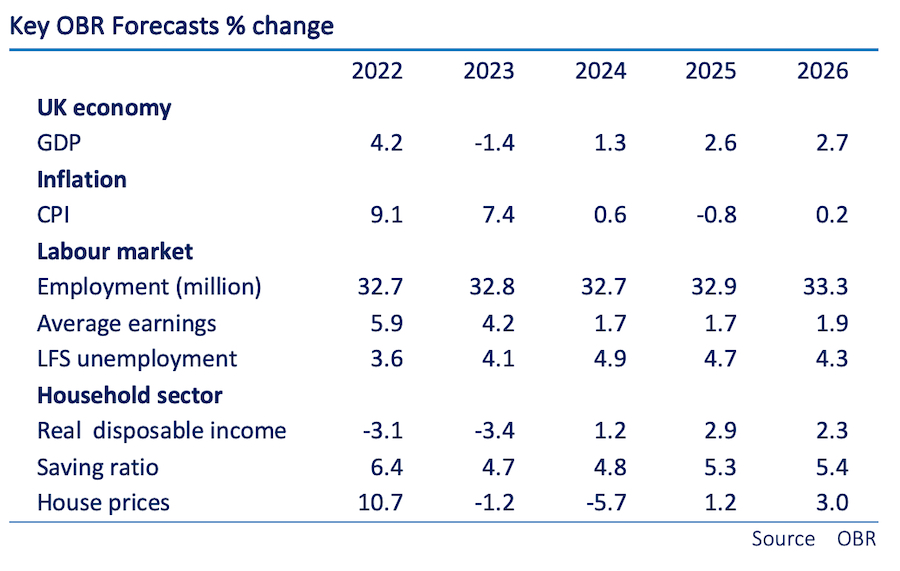

After all, just because they have been spectacularly wrong almost every time does not mean they will be wrong this time of course! Below, then, are the OBR’s GDP, CPI and employment forecasts, do you think they are a fair central case?

The three key assumptions they make relate to GDP growth, CPI and employment levels. In each case I believe their forecasts border on magical thinking. Their optimism enables the fiscal deficit (amount HMG borrows) to rapidly evaporate over the next few years, thus giving Jeremy Hunt the green light for his brutal Budget.

First, the OBR sees a very shallow recession with a GDP decline of 1.4% in 2023 then bouncing back strongly with by 2025 consistent growth above 2.5%. Second, it assumes inflation (CPI) peaks now and begins to fall in 2023 – but from 2024 there is effectively almost no inflation at all and even some deflation. Third, it assumes, despite recession, that unemployment remains sub 5% while the level of those actually in employment is steadily maintained.

Dealing with GDP growth – given the scale of the challenges from rapidly increasing mortgage and utility costs, to the unpredictability of war, to the highest tax burden since 1948, to the aftershock of lockdown and parlous levels of Government indebtedness – a shallow recession of that magnitude looks very optimistic.

Moreso, the UK has not grown consistently at above 2.5% pa – as the OBR suggests will happen by 2025 and onwards – since the early 2000’s. Where exactly is this growth to come from in a highly taxed, macro-managed economy? It’s not obvious to me.

Indeed this Government has done more than any to destroy the engine of growth – low and stable tax, modest and proportionate regulation and the rule of law. The converse simply undermines the UK’s competitive position and not many of the top 1%, who pay 27% of the income tax base, need to decide it’s sunny in Oporto with some decent wine before the domestic base is totally undermined. That does not look like a recipe of 2.5%+ growth to me.

On inflation the OBR forecasts effective deflation from 2024 based on the view that higher carbon prices will wash through as a one-off, coupled with the dampening impact of recession. While I accept both factors this analysis ignores some key counter- trends.

First, given HMG has confirmed it will increase out-of-work benefits in line with CPI (currently 11.1%). This suggest that pay deals with public sector unions are likely to be on the generous side. While the nurse’s demands of 17% might be opportunistic does anyone really believe this Government has the stomach for a fight?

What signal is it to Unions if the growing ‘can’t work’ sector get a CPI rise? Surely large public sector pay rises are on the way doubtless linked to rather dubious long term public sector productivity targets? Higher wages can clearly be inflationary in themselves and with the state 48% of GDP, with weak productivity, this must undermine the OBR case.

Second, regardless of what happens in Ukraine, Nord Stream 1 & 2 are no more and Russian gas is most unlikely to be tradable in the West in the long term. The recent price rises may be one off but with hedging strategies and lead times it is surely naïve to believe inflation does not remain inbuilt in the system in the medium term? High carbon prices are most probably embedded.

Third, while interest rates have risen sharply, which is a clearly a dampener, real yields remain strongly negative, continuing distortions.

Fourth, the cancellation of Russia has extraordinarily accelerated the net zero agenda in the policy arena. This is also inflationary embedding even with higher energy prices.

Fifth, and critically, the aftershocks of lockdown remain in terms of labour availability, supply chain disruption and the like with producer price inflation well ahead of CPI throughout Europe.

And on unemployment to suggest, as the OBR seem to, that there will be no net decline in total employment is, in our view, eccentric.

All the foregoing really matters because it impacts both tax receipts and spending pledges.

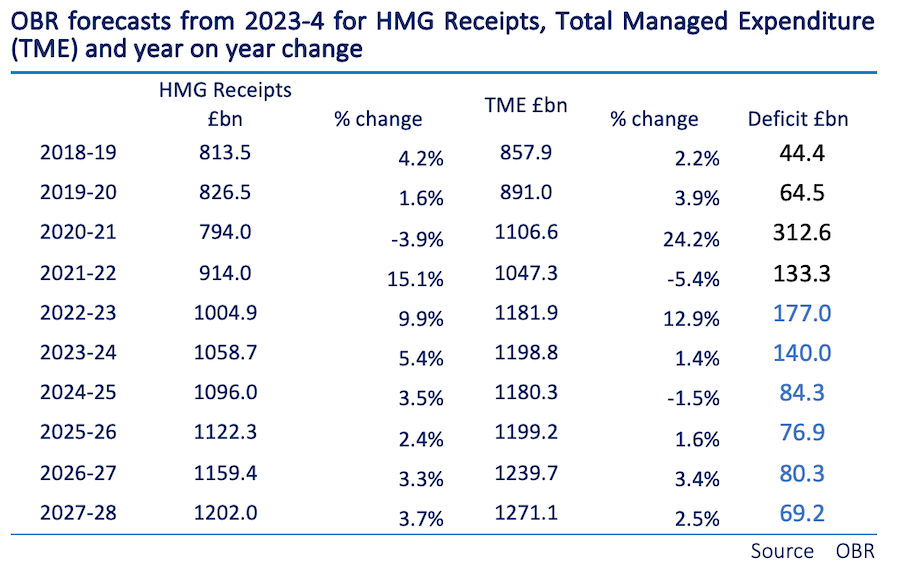

As can be seen from the chart below, the OBR assume stable tax receipt growth but also extraordinarily tight control of expenditure – which, frankly, flies in the face of recent experience and likely pay settlements. With these assumptions the fiscal deficit falls sharply by 2024-25 as the self-professed ‘grown-ups in the room’ work their wonders.

The philosophical underpinning of this budget is, however, based on a very optimistic assessments of what will likely happen. Magical thinking if you like.

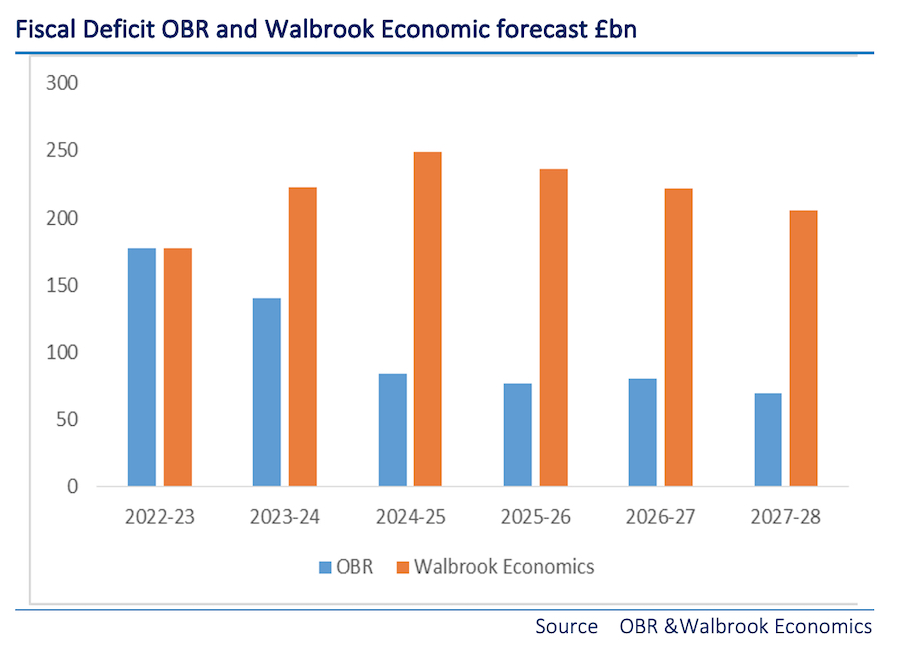

The amount governments borrow is highly sensitive to a number of key factors of which GDP, CPI and unemployment are key. Small changes have a big effect. Using my central case, which is not even close to my worst case, gives a very different answer.

I have modelled GDP decline of 2.5% in 2023 and 0.5% in 2024 and much more muted recovery from 2025 (range 1.5-2% growth) onwards; assumed also peak inflation in Q1 2023 but a more gradual decline than the OBR’s forecast remaining above 3% throughout the control period; and, a net reduction in employment of 750,000 (3% workforce) by 2025. I do not believe these are aggressive assumptions at all.

Crunching these assumptions the fiscal deficit peaks in 2024-5 at just under £250bn but remains embedded even by 2027-28 above £200bn. The contrast between my forecast and the OBR’s can be seen in the chart below. Such an outcome would be disastrous. The highest taxes on record and still an unsustainable deficit. The economic and political choices would be unpalatable indeed.

Of course readers can draw their own conclusions on what are fair and reasonable assumptions and there will be a range of reasonable views – but in my judgment the OBR’s views are, well, let’s just say a touch optimistic! Magically suspending belief, we must hope they are right.

What I can say is this Government’s response is destroying Britain’s competitive position both relatively and absolutely and with it the longer term wealth that generates the tax base. Hunt and Sunak may feel smug as they high-five in the Commons that the markets support their positon. On this I am very far from convinced, as central banks overwhelmingly control their own yield curve and thus potentially exert enormous economic and political power.

Back on planet Earth they have taken the weak and cowardly option of further chipping away at an already gravely weakened edifice. Rather than curtail public spending and recycle that to the productive wealth-generating section of the economy they have done the very opposite, redistributing an ever-smaller cake.

If you If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City Economist whose career has spanned over 30 years. He is Director of Global Britain and his work is widely published in economics and political journals.

Image by T Studio from Adobe Stock