By Ewen Stewart – 6 minute read

THE LAST two weeks, since Kwasi Kwarteng’s now infamous budget, have perhaps been the most extraordinary in modern British political recollection.

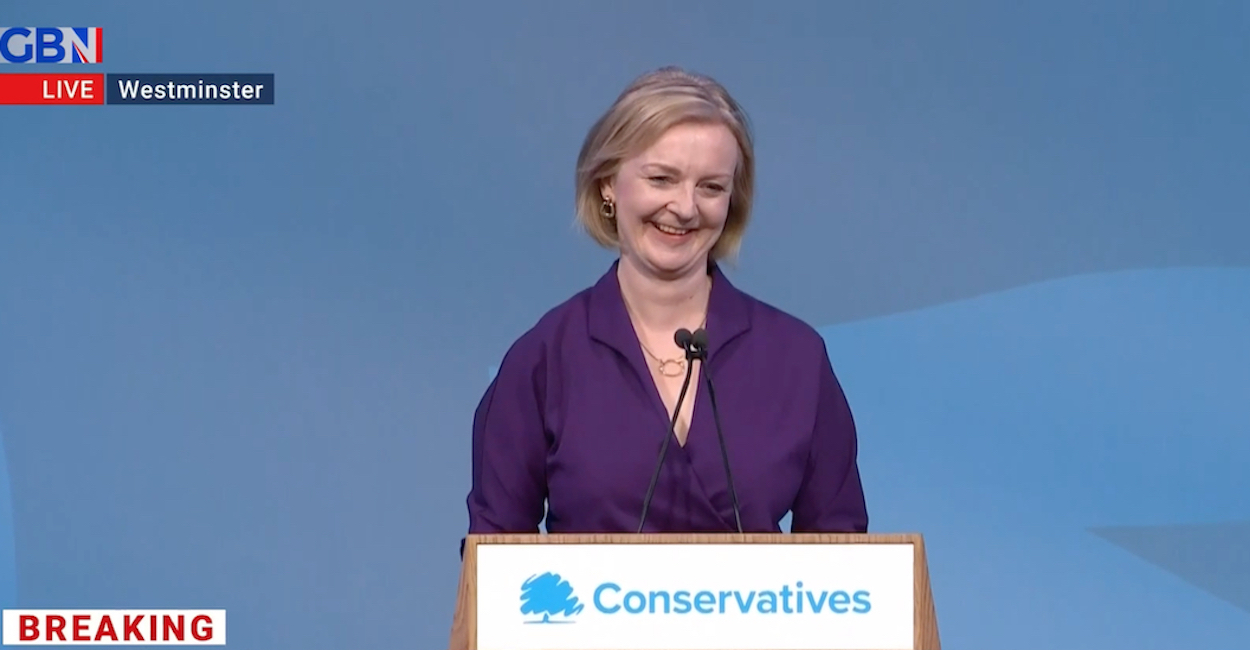

Truss and Kwarteng condemned, with almost religious like certainty, from a whole host of commentators from the IMF to Germany’s finance minister, from the usual suspects like the IFS and BBC, to even Conservative voices like Gove & Friends.

These voices have got their way with Kwarteng shown the door in record time, replaced by the declinist consensus in the name of Jeremy Hunt.

They say the Budget was irresponsible. It was unfunded and has caused chaos.

What they all parrot is that things were OK until these two philistines wrecked the good ship Britannia. Really? Do they really believe that?

Truss inherited one holy mess. The timing of the Budget was extremely ill advised for sure, but this mess was entirely created by our political class over many years. It is absolutely not true to claim all was well before Truss. It plainly was not.

We should be living in a land of milk and honey. At every level our civilisation has created wonders, previous generations would simply not believe from every labour-saving convenience to global travel, as well of course huge advances in the fields of science, technology, medicine and communications. These advances were largely created by private innovation and not public direction.

Almost all have seen extraordinary advance over what was on offer for our grandparents. The gift of the western mind to the entire world is immense.

But our Albion does not feel like a land of milk and honey today. The country is riven with discontent, division and rancour like never before and in my view that rupture is predominately down to disastrously poor policy choices made over many, many years across almost the entire West, but particularly here.

Politicians have meddled, often out of short news flow management and expediency, kicking the incendiary can down the road believing they can create some liberal, egalitarian utopia. Instead, they have created an unhappy divided land.

The real catalyst of our economic woes today was the fundamental breech with sound money. Governments taxed (usually too much) but they were constrained by the simple laws of economics that Government spending was based broadly on the productive success, or failure of the nation.

Gordon Brown and Alistairr Darling changed that by adopting novel quantitative easing in March 2009. Perhaps it was justified as an emergency measure to quell the impending banking crisis? But whatever one’s take it was expedient and set off a time bomb that is now exploding globally.

The real damage, however, was done during Mark Carney’s tenure from 2013-2020 and immediately after. In common with the Fed and ECB, central banks failed to normalise interest rates and end QE creating a new normal of near free money.

This encouraged Governments to borrow in an unprecedented fashion outside war. British debt increased fivefold in just 15 years to an eye watering £2,400bn (or around £85,000 per household).

And if money was elastic and increasingly unrelated to real economic activity why not just do even more? Build that school, duplicate that railway, spend £500bn locking down the economy. It seemed reminiscent of Poussin’s great painting ‘et in Arcadia ego.’

But of course it was a delusion. A convenient one for sure, as what was not to like about rising assets prices and endless spending? But this policy was without precedent in the 300-year old history of the Bank of England and it could not last. The only question was when would it blow?

The answer unfortunately is now. Not with the budget two weeks ago, as the architects of free money would have you believe, but with the decade-long unsustainable fiscal and monetary response coming to a necessary global end.

The lockdown (x3) was one major error too many and caused immense economic harm with supply chain issues, work disruption and ‘free money’ starting to fuel inflation.

The consequences of war in Ukraine and subsequent cancelling of Russian hydrocarbons, without ready competitive alternatives, only made matters much worse.

As inflation soared the ‘free money delusion‘ came to an abrupt end, globally. With the Fed tightening and the Bank of England and ECB doing the same, albeit more timidly, the game was up.

Worse, ‘free money’ over so many years had gravely distorted economies. It made housing increasingly unaffordable, diverted wealth into unproductive areas and gave Governments the power to do as they pleased without apparent sanction from global markets as central banks suppressed the yield curve globally.

The state grew out of all proportion. In the UK public spending increased by 24% between 2019 and today for an inferior service. Regulation increased exponentially with barely an industry untouched from the hand of government.

Within a short period Britain moved from a moderately taxed and regulated economy into one which is increasingly unstable with a state consuming almost half of GDP, taxes at a 70-year high and micro regulation in almost all spheres of life, while tossing out carbon security for unproven and currently uneconomic alternatives.

It is thus no surprise growth declined markedly and on a per capita basis became almost non-existent.

There is no doubt Kwasi Kwarteng’s budget was ill-thought out and poorly timed. It was half a budget. Tax cuts and deregulation needed to be balanced with real spending cuts.

It is also true that as central banks tightened it made running large deficits unsustainable. The instinct was right but it was not a wise budget at this time.

We must not, however, be fooled by the crowd into forgetting the instinct of reducing taxes and regulation was right and indeed critical given the mess we are in.

But the alternative proposed by former central bankers, and politicians like Starmer, Gove and others is entirely the wrong approach. Their remedy is more tax, more spend, more decline and even less freedom.

This cowardly Conservative Party has created the worst of all worlds. A sacked chancellor, a total U-turn, a captured PM and whether there is another coup or not doesn’t really matter as it’s more of the same for two years.

It now seems the Tories have accepted the declinist school of mediocrity and control. Thus, in all likelihood we can look forward to a super charged Labour Party increasing the tax, spend and control ratchet yet further.

That will crush the remaining damaged private sector engine of growth of this country, lead to weak investment and accelerate decline. That must be obvious.

Labour is riding high promising an even more extreme form of state control than Johnson and Sunak. The left-liberal consensus that it was ‘tax cuts and deregulation that did it’ is complete nonsense.

The crisis is global, Kwarteng’s now abandoned tax cuts of £45bn are small beer compared with £500bn on lockdown and in any case only take tax, as a proportion of GDP back to where it was in 2021. Hardly radical. But misunderstand the illness and you get a quack cure.

We have got used to wealth but have forgotten that to create it requires a complex web of stable government and the rule of law, a high degree of liberty but also innovation, competition and hard work. But prosperity, civil discourse and quiet governance cannot be taken for granted.

Argentina, before Peron ruined it, was one of the wealthiest nations on earth. For 70 years they have failed to recover their mojo. Yes, they have nice wine and decent food but they stumble from one crisis to the next with the middle classes destroyed and mediocre care for the poor.

Once equilibrium is lost it is hard to regain as recriminations, blame and the illusory search of a false Rousseau-like utopia create discord, disharmony and decay.

Make no mistake, Starmer, if elected, will exacerbate this crisis and with £2,500bn of debt he too will be forced to cut the cloth. His solution will be tax and regulate yet further.

Growth will wither, interest rates will rise to fund unsustainable debt and with that the remaining wealth of the nation will decline, perhaps materially.

There is no doubt this is a turning point and compounds the error – the price to all, rich and poor, will be very high indeed.

Broadly if we are to have any future we have to regain a sound monetary policy, trust the family unit, encourage enterprise and re shape the state to a sane, effective and sensible size.

That means unwinding the excesses of the Sunak/Johnson years, reducing materially the size and scope of the state, freeing us from micro regulation and cutting tax gradually but consistently over time.

As the end of free money will result in a major asset price readjustment the good news is that while the next few years will be tough for all across the West, supply side changes that reduce tax and regulation allow the private sector to grow very quickly. We just have to hope there are some left after today.

Blair expanded the state to around 40% of the economy, but the Conservatives took it to the next level, almost ten points higher. Now that is not enough for our Establishment but they are entirely wrong in their analysis.

Appointing Hunt as Chancellor says all we really need to know as to how our political class thinks. But ultimately their consensus is doomed to fail. If we wish to live in a prosperous land there is no alternative to blood, sweat and tears.

If you If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City Economist whose career has spanned over 30 years. He is Director of Global Britain and his work is widely published in economics and political journals.