By Ewen Stewart – 4 minute read

I AM NOT a regular reader of the New Statesman but occasionally it’s worth enquiring into the strange world of the left-liberal mind. I was thus drawn to a recent article it published Britain’s great tax con by editorial staffer, Harry Lambert, which makes the extraordinary claim the tax system embeds wealth.

The basis of this thesis is there is massive and widening inequality, labour is taxed heavily, capital is not, and the local council tax is inequitable – hitting the poorest post-Covid most. Moreover, an incoming Labour Government will need to raise more money to ‘level up’ and undo all that austerity and under-investment the public sector has allegedly suffered.

Where to start?

Firstly, the great myth of inequality. While not accepting the philosophy that a levelled society is the most just (as it is both utopian and goes against the natural call for and response to incentives of all societies), so called Marxist ones included. Frankly, as the following details show, the UK is not the unequal nation so many claim.

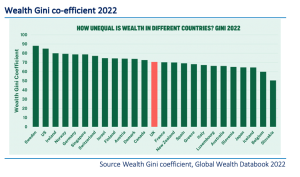

We are grateful to the Equality Trust for the chart below which shows that in terms of wealth amongst developed nations the UK’s wealth distribution lies between Canada and France. Sweden, US, Ireland, Germany and Canada are all less equal. Appearing bang in the middle of the chart, the UK, is already a fairly levelled nation.

What is more, after twelve years of Conservative/Liberal Democrat and solely Conservative rule the UK has taxed more and that has squeezed wealth further. The cake has not increased and the wealth remaining has been re-distributed yet more. The cry that ‘the rich are getting richer’ on the back of the rest of us is simply untrue.

We all know taxes across the UK are at their highest rate since ration book Britain in 1948 – which in itself is quite something. Tony Blair inherited an average tax rate of 29.8 per cent GDP. The rot started with him but at least taxes averaged just 31-32 per cent of GDP. According to the OBR, tax will rise to 37.3 per cent of GDP this year – almost 6 points above the Blair average.

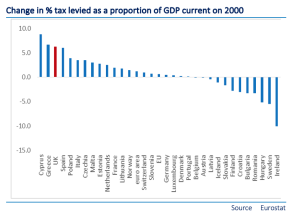

No major European economy, repeat – no major economy in Europe – has increased taxation to anything like the extent of the British as outlined by the chart below. For a country that bases its business model USP largely on its global competitiveness such a move is quite extraordinary – and also quite extraordinarily stupid.

Moreso, as can also be observed from the chart above, a few countries have materially cut their tax burden over that period, in stark contrast to the UK. Sweden and Ireland are perhaps the most obvious examples.

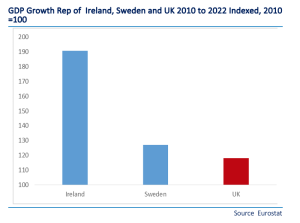

What does that mean? We can observe from the chart below the impact.

Since 2010 UK GDP is up 18 per cent, about as miserably bad as the EU average, but Sweden has seen 27.1 per cent growth while nominal Irish GDP is up a staggering 90.6 per cent! Of course there are a range of factors at play but the correlation between growth and tax cutting is very clear and Britain has moved catastrophically in the wrong direction. Not a word on this from the New Statesman, of course.

The New Statesman article then goes on to say the current tax system enshrines inequality. Really? Well, as we have observed Britain is, by international standard already quite an equal society, but to quote the London School of Economics research “The top one per cent pay 30 per cent of all income tax revenues: a higher share than at any time in past twenty years. In other words, three in every ten pounds that the government receives in income tax is paid by just over 300,000 individuals.”

That is quite a statistic. If I was the Chancellor I should be very nervous and ensure that small band who fund so much remain content to stay in the UK. I note that Portugal, Ireland, southern Italy and now even Germany with their recent €30bn corporation tax cut, have smelt the coffee.

Portugal has some decent wine and is quite Anglophile, for example, and for most of the year is pleasantly warm. In the internet age location matters less and the UK is in a highly precarious position. Its reputation as a low tax, stable and secure country is pretty well trashed.

Further, in contrast to the New Statesman’s claims we already have substantial wealth taxes – they are just not called that. Stamp Duty can be considered as much and at 5 per cent, 10 per cent and at the top rate 12 per cent for more expensive properties, is both a major impediment to mobility and a tax on wealth, as are Inheritance Tax and Capital Gains Tax. And remember wealth is, for the vast majority, the accumulation of savings which have already been taxed.

The claim the local Council Tax is inequitable misses the point completely. It varies widely because it reflects local conditions and needs. Also, is it not a tax for local services which are often more fully used by the less well off?

Despite increasing tax complexity and constantly changing the rules the real difficulty that needs addressed in the UK is not tax per se but our public spending which remains utterly out of control and causes our taxes to be so high.

We have reached a tipping point where further tax rises will not only be inequitable, but totally counter-productive. Frankly, the UK economy is going the way of Italy’s – zero growth and no wonder.

The private sector is smaller today than it was in 2016 while all the growth has gone into largely grossly inefficient public spending. It’s a black hole. As one example, consider spending on the NHS: it was £164bn in 1919-20, today it is 238bn – a 44 per cent rise. Despite this, and partially as a result of the foolish lockdowns, waiting lists are up massively and the availability of a GP is non-existent as readers will be all too aware. Health spending alone is close to £10,000 per household per annum well ahead of the EU average for a generally rationed and poorly organised service.

In 2019 Boris Johnson inherited total public spending of £888bn pa. According to the OBR it was £1154bn to March this year – a staggering rise of 30 per cent, or some £160bn more than inflation. £1154bn is £41,214 per household. £41,214!!!

Ask yourself what does your household get for your £41,214? Not much I would wager. It should be more than possible to provide a decent range of services for a fraction of that.

This is all very depressing, but the good news is it would actually be rather easy to fix if we had a Prime Minister determined to tackle the real problem of ballooning spending.

Here are some simple ideas for starters:

- a) Mandate all government departments to normalise spending back to pre-lockdown levels – hardly austerity – yet a rate still some 10 points higher than the Blair years. The saving after inflation would be £150bn

- b) The welfare budget, which now exceeds three hundred billion per annum, needs to be re-purposed towards encouraging work. Benefits should now be frozen for two years, post the absurdly generous 10 per cent rise this year, far more than most who actually work received. The hypothecated saving, depending on inflationary assumptions ranges between £30-50bn.

- c) Cancel HS2 as an old technology, at cost now in excess of £100bn it’s totally and clearly absurd.

Three simple ideas to cut £400bn of aggregate spending. Recycle half in tax cuts and the rest on the gradual process of reducing the out of control national debt. Quickly the ship would be stabilised, we would send a clear signal of seeking to live within our means and the UK would enter a virtuous circle of growth and leadership while breaking the shackles on families for such utterly appalling service.

If you appreciated this article please share and follow us on Twitter here – and like and comment on facebook here. Help support Global Britain publishing these articles by making a donation here.

Ewen Stewart is a City economist whose career has spanned over 30 years. He is director of Global Britain and a co-founder of Brexit-Watch.org.